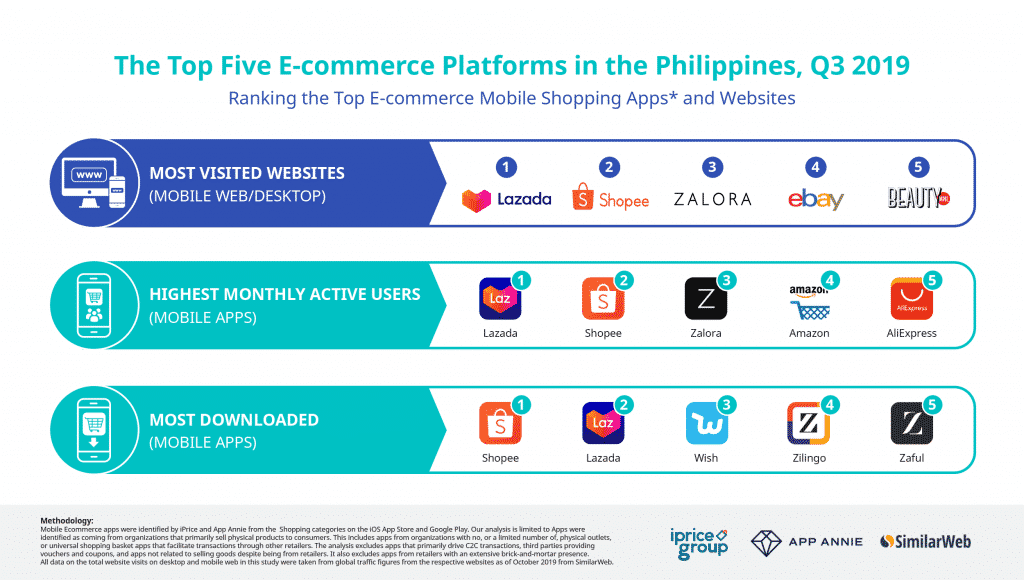

According to research, Lazada, Shopee and Zalora have consistently been the top 3 players of the Philippines’ e-commerce market, while homegrown sites Beauty MNL and Argomall have both proven to be consistently competitive in the top 7 in terms of market share. iPrice Group, in partnership with App Annie Intelligence and with data from SimilarWeb, conducted a research on the top e-commerce platforms in the Philippines for the first three quarters of 2019 to encourage the country’s online economic growth potential, as seen in the joint e-Conomy SEA 2019 report.

The e-commerce shopping apps were ranked via the average monthly users (MAU) of its existing mobile apps and total market shares, obtained from the total web visits among platforms, in Q2 and Q3 of 2019.

Lazada’s Commitment to Keep its Rank

Lazada, consistently reigning the top rank, has garnered the most average monthly users (MAU) for all three quarters of 2019. Its market share reached 60.8% in the third quarter, with a total web visit of 35,619,900, growing from 55.3% in the second quarter. It has the second most downloaded e-commerce shopping app in the second and third quarter of 2019. Aside from its initial outstanding initiatives such as the launching of LazMall, in-app live streams and in-app consumer games, Lazada continues to step up by constantly investing in technology through tools and services that help merchants and sellers, which included marketing solutions package and business advisor dashboard. These tools welcome more traffic to their partner brands while enabling better decision-making by providing real-time information.

“We already provide more than 20 tools to our merchants. We will continue to do this. Our goal is how to digitize economy and empower merchants, entrepreneurs and brands,” stated Lazada Group CEO Pierre Poignant in an interview reported by Philippine Star earlier this year.

Shopee Remains the Most Downloaded E-commerce Shopping App

Its main competitor, Shopee, remains number one in the most downloaded e-commerce shopping apps in Southeast Asia. It ranks second in terms of MAUs, with a market share of 33.9% in the second quarter and 31% with 18,174,000 web visits in the third quarter. Notably, Shopee has one of the most impressive growth in terms of total visits, with an increase of 376% in the last two years. At this rate, it is deemed to have a very high potential for immense growth.

As for the years to come, Shopee has no intention to plateau. They aim to reach more local presence by capturing the market of first-time online shoppers as they recognise the country’s room for online economic growth.

“In the Philippines, I think the priority is still very much on growing,” said Shopee Chief Operating Officer Terence Pang in a recent report from BusinessMirror. “If you imagine, there are thousands of Filipinos who are coming online and making their very first purchase in their lives everyday. So what Shopee needs to do is provide them with this excuse to come on and develop that habit with us and build this relationship and help them buy more things online.”

Zalora Expects More Annual Growth

Fashion e-commerce site, Zalora, has remained the third most competitive player in the Philippines in terms of MAUs for the first three quarters of 2019. Its high performance achieved 3.2% of the market share in the second quarter and 2.6% and 1,539,500 web visits in the third quarter. It continues to be bullish as it constantly expands its partnerships with big brands like Bench, SSI Group Inc., Penshoppe, Nike, Adidas, Marks & Spencer, garnering them one of the top choices for online retail shopping. As Zalora recognises the Filipinos’ shift to online shopping, they expect a 50% annual growth for the next five years.

“We will end the year with more than 50% growth year on year and we expect that trajectory to continue,” said Zalora Group Chief Officer Gunjan Soni in an interview with BusinessWorld earlier this year.

With the launch of Zalora Now, a subscription service that allows consumers to receive their products the very next day, it comes as no surprise that it has the 5th most downloaded e-commerce shopping app in the 2nd quarter of 2019 and the 6th in the third quarter. Zalora Philippines Co-Founder and Chief Executive Officer Paulo L. Campos III said in a statement reported by BusinessWorld in 2018 that 75% of their business is from the mobile app as of 2018.

Bright Future for the PH’s Online Economy

The Philippines continues to allot space for e-commerce to thrive in. Local e-commerce sites have been emerging and it continues to rise up the ranks in terms of market share. In the second quarter of 2019, tech shopping site Argomall took the 5th rank with 1.6% of market share and Beauty MNL right behind with 1.3% of the market share. In the third quarter, Beauty MNL overtakes Argomall with 1.4% of the market share, slightly trailing behind eBay.

The country’s economic environment welcomes further growth not just for the local e-commerce players, but for the international e-commerce giants as well. The Department of Trade and Industry launched the Philippines E-commerce Roadmap 2016-2020, the country’s first on e-commerce. DTI has been taking proactive steps in pursuing this. Recently, a Memorandum of Understanding was signed to establish a partnership on e-commerce policy. DTI also continues to seek assistance from e-commerce stakeholders in identifying issues and recommendations for the 2022 roadmap.

Between the determination of the Philippines’ e-commerce players and the support of the Philippine government, it is difficult not to see a bright future for the country’s online economy.

Read the full report here to find out more. You may also download the report for Southeast Asia.

The Map Of E-commerce In Singapore

iPrice curates highly insightful data that are unique and unbiased in the world of tech, e-commerce, and online retail by providing data-rich, interactive, and media-specific targeted content that varies from the latest tech trends to the top e-players in Southeast Asia. They also provide high-quality country-specific insights and data on seven markets, namely Singapore, Hong Kong, Vietnam, Thailand, Indonesia, Malaysia, and the Philippines. Through collaborations with data partners such as App Annie Intelligence, SimilarWeb, and Parcel Perform, iPrice has been featured on numerous prominent publications including South China Morning Post, Bloomberg, Motley Fool, Nasdaq, IGN, and Tech Crunch, to name a few.