By, Germaine A. Reyes and Lorenzo D. Reyes

The pandemic has certainly accelerated digital adoption and has left some brick-and-mortar shops including its merchants needing to recover from purchase shifts to e-commerce brands and other channels. Due to the quarantine and social distancing needs, there is an obvious decline in foot traffic and frequency in visiting malls these days and purchase of food, non-food and other items have shifted to either e-commerce brands and/or other channels such as direct-to-consumer-from-supplier channel and other means. The challenge therefore is how malls and other retail shops can pivot to capture these behavioral changes while at the same time staying relevant to and meaningful to the consumers these days?

There are insights gleaned from the analysis made by Synergy Market Research + Strategic Consultancy 1 on data culled from the following studies:

- COVID-19 Behavior Tracker 2 of the Imperial College London in collaboration with YouGov 3, comparing PH to other ASEAN countries

- YouGov’s Consumer Monitor Tracker (CMT) and Economic Recovery Monitor (ERM) 4

- YouGov Profiles 5 – one of the syndicated solutions offered by YouGov.

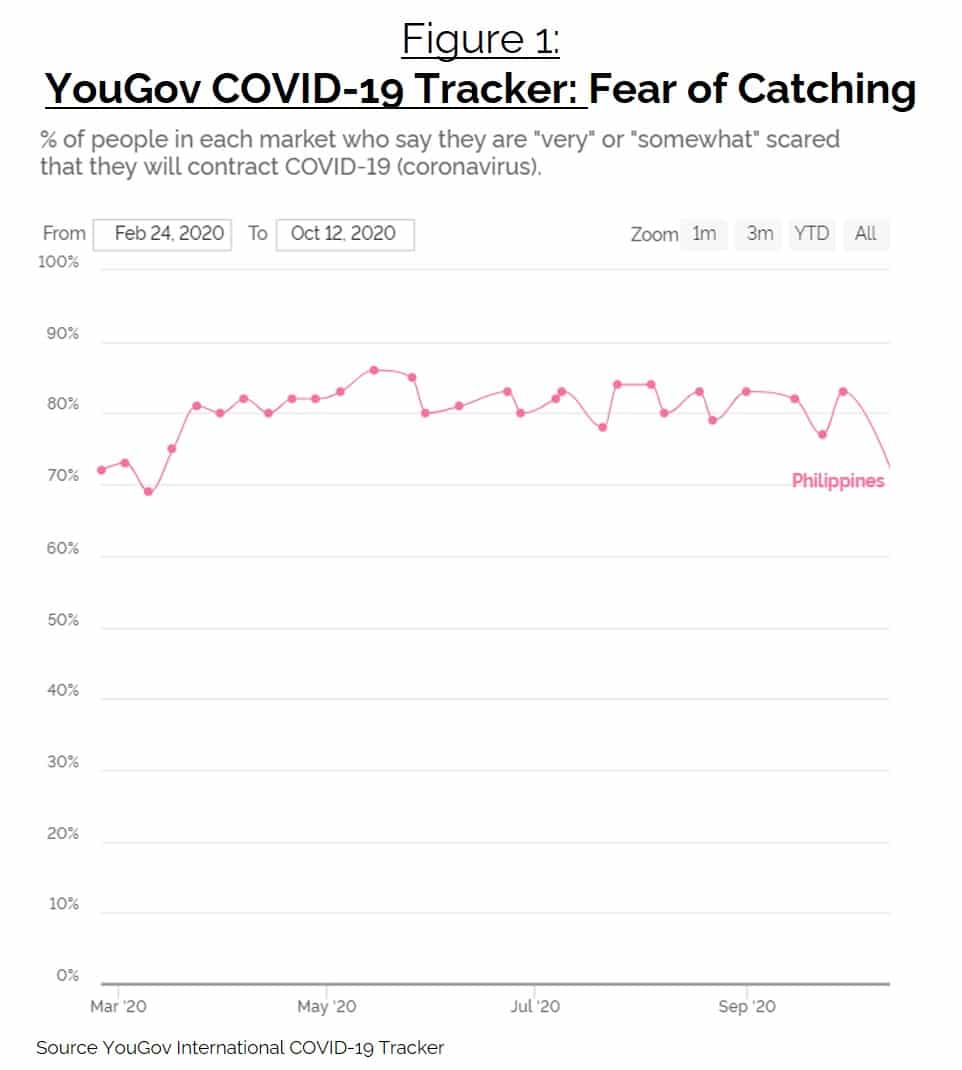

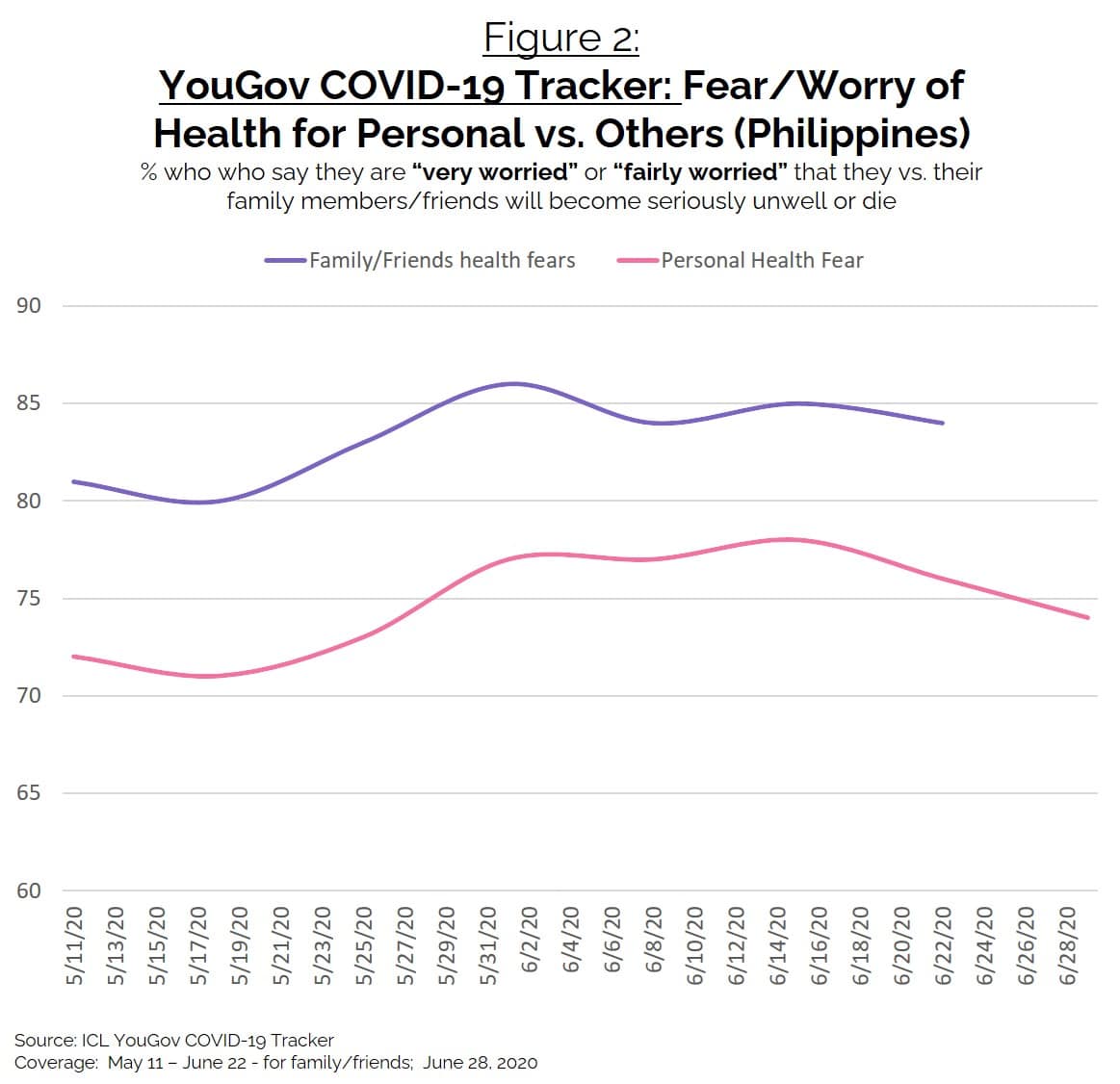

Filipinos from the start of the quarantine have been fearful about COVID-19 and this has continued to remain high in the Philippines (>80%). Possibly, it is because of fear for other family members and friends (more than personal safety) – the thought of having a family member suffer from coronavirus probably is more aggravating than the thought of personally contracting this (more stressful among the millennial and younger generations per other studies analyzed6). [See Figures 1-2].

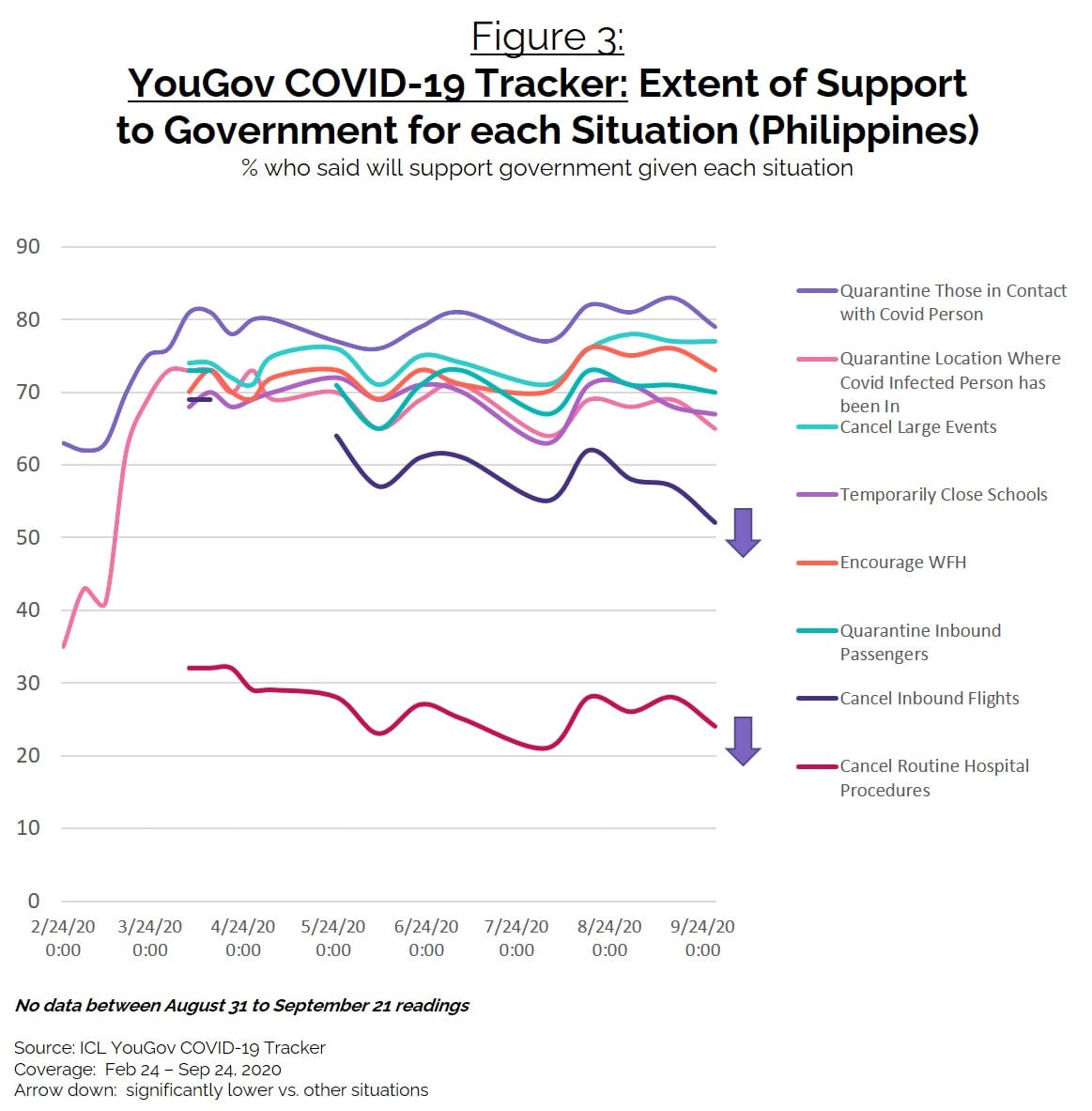

Of the many situations that the government is undertaking or could undertake for the COVID situation, it is the cancellation of hospital care procedures that people will be the least supportive of IF the government will impose stopping these routine hospital procedures. This implies that people believe in providing health care for all patients, not just those that have contracted COVID. [See Figure 3] The people would most probably want to be assured that care for other ailments and health needs need to happen and should be part of priority of the government.

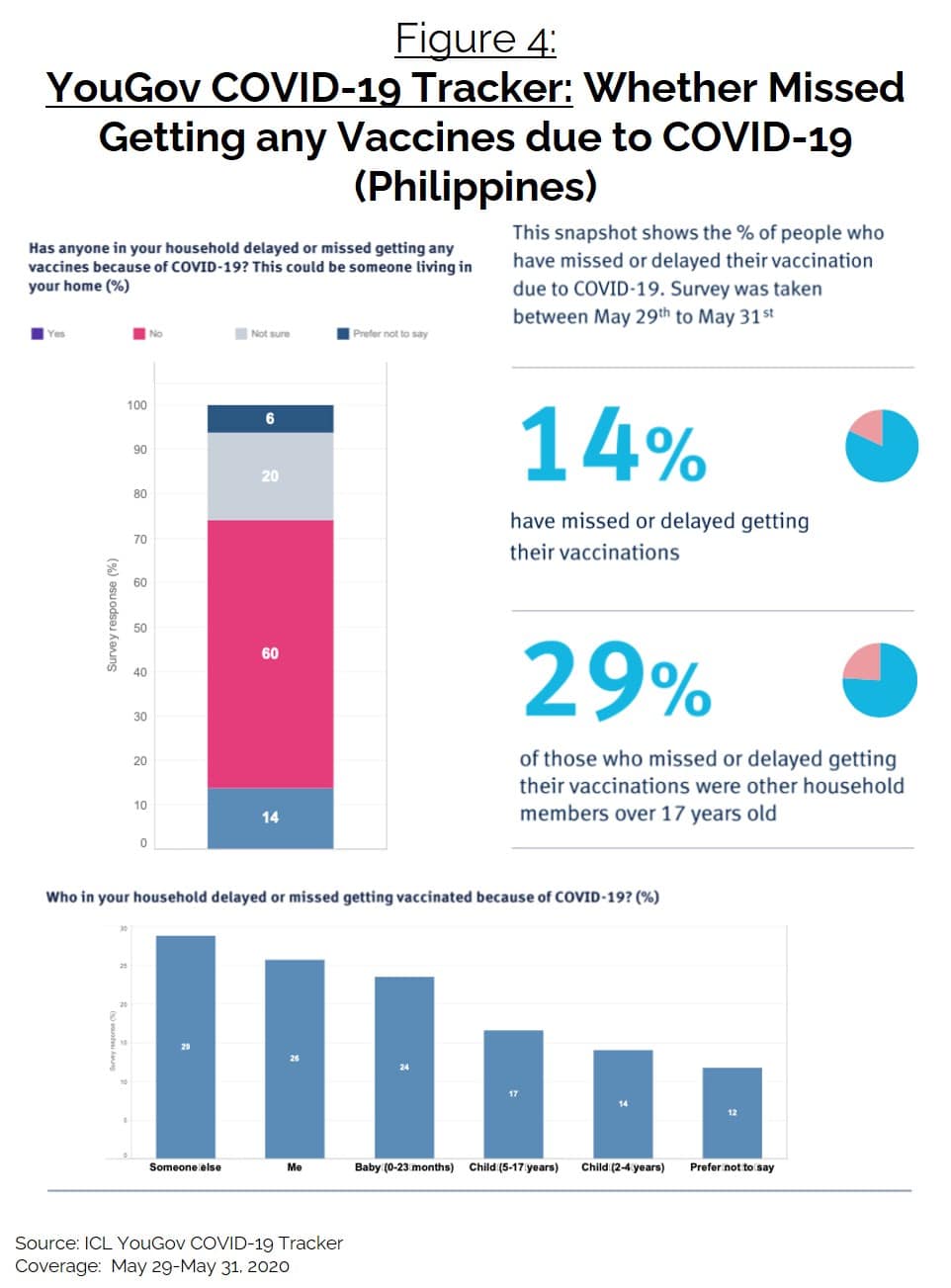

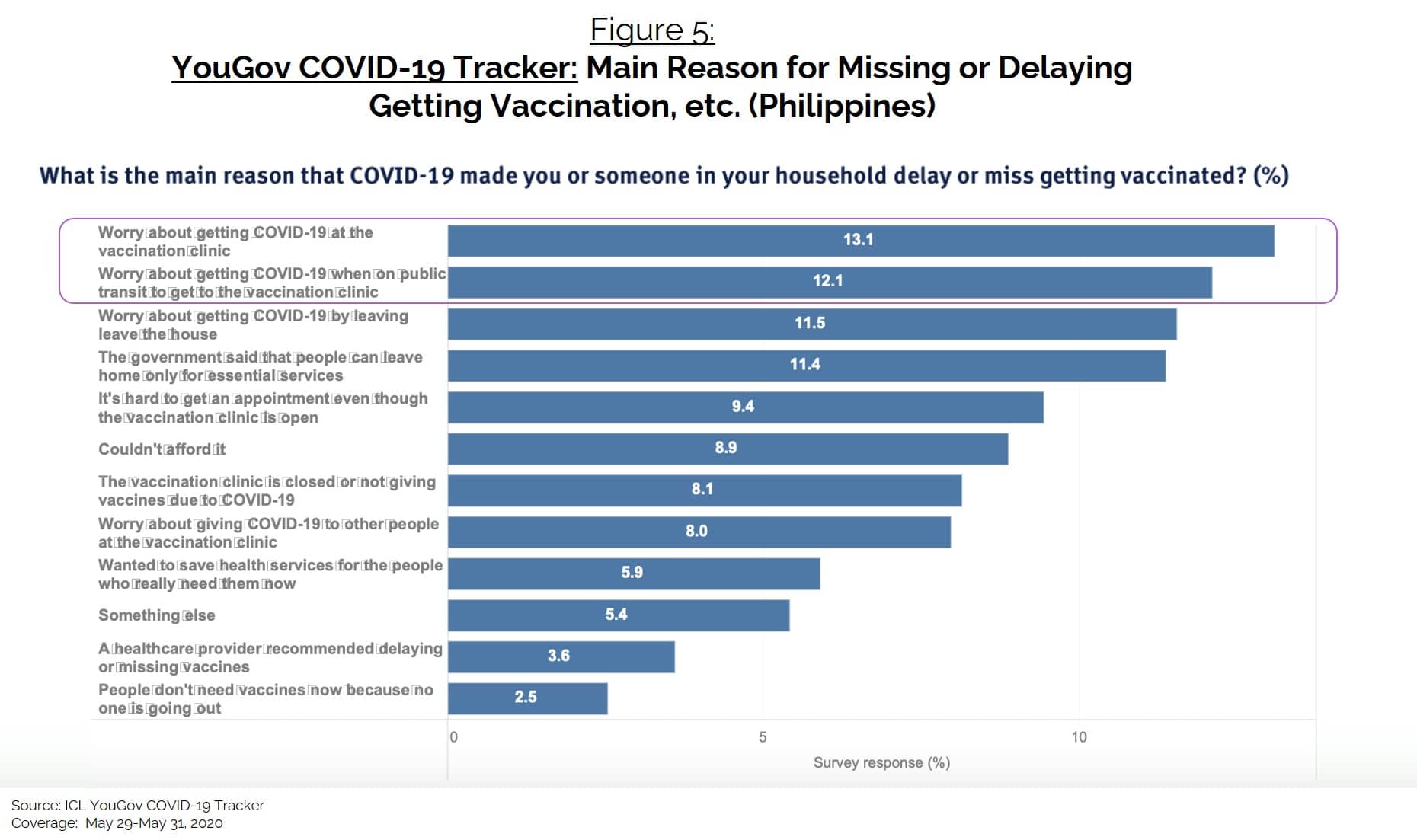

However, what may be worrisome is that a substantial number of people (14%, which is a significant absolute number when projected to total population) have missed their vaccinations (and possibly other check-up needs). They are 17 years of age and older. [See Figure 4]. Main reason for missing their vaccinations is that they fear contracting COVID in the health clinics (or hospitals) that they will go to and while in transit, i.e., in public transport to get to the clinics. [See Figure 5].

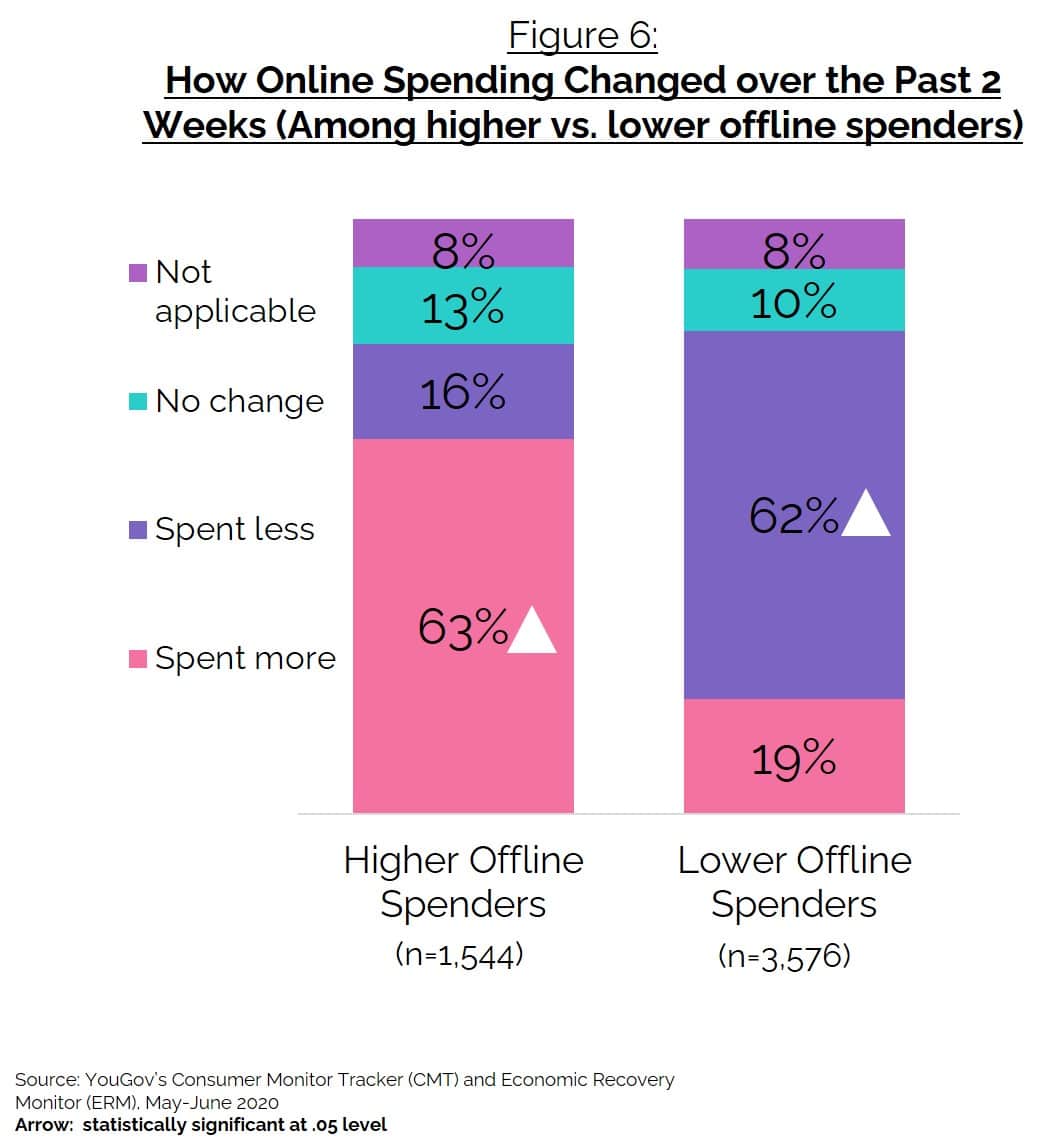

Meanwhile, from a purchase behavior standpoint, during this pandemic, there is a significant overlap seen among those who have spent more money offline during COVID-19 who also tended to spend more online as well. This indicates that almost all who are higher offline spenders in recent times are able and ready online buyers as well as only 8% of these higher offline spenders do not buy anything online. [See Figure 6].

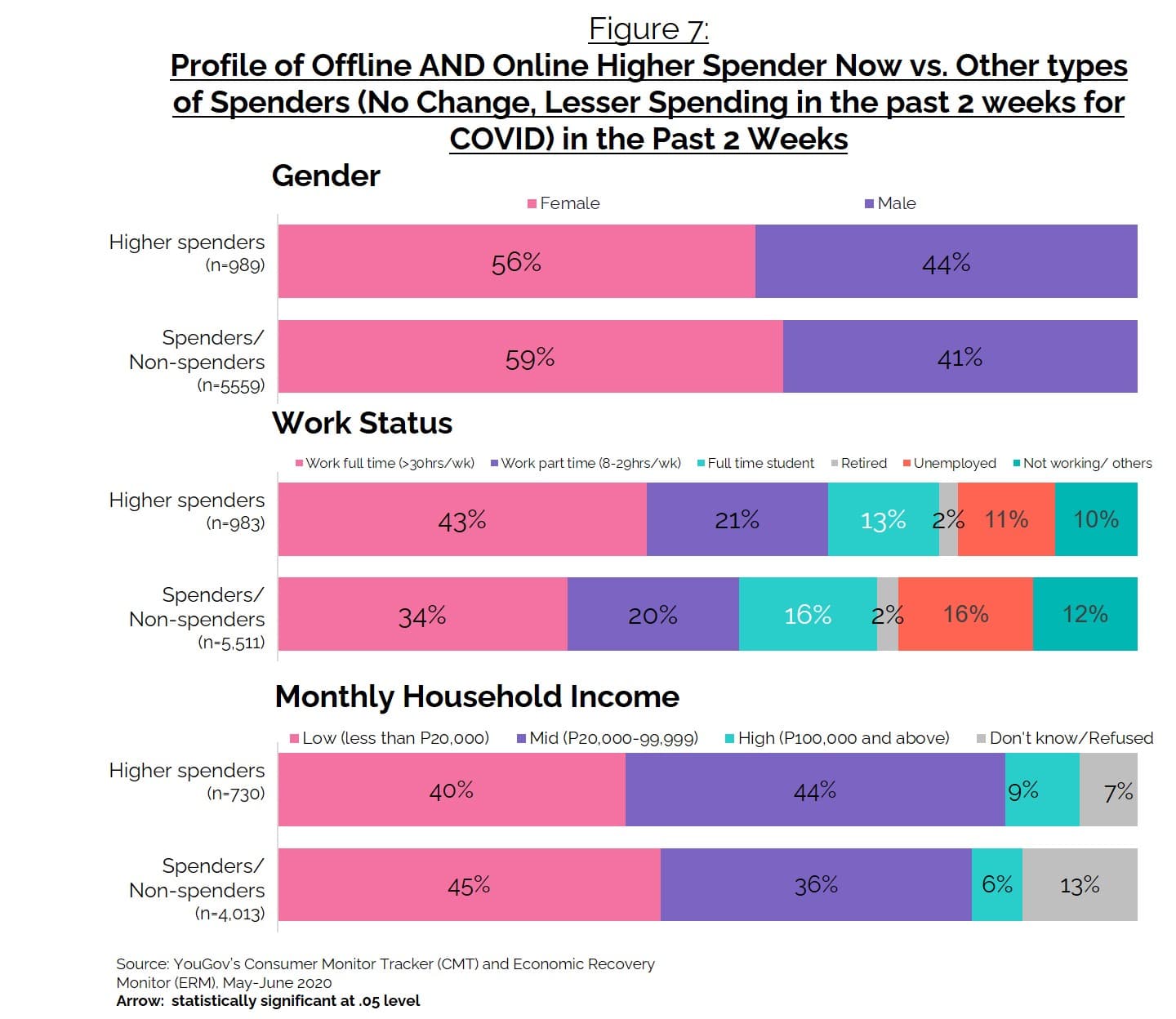

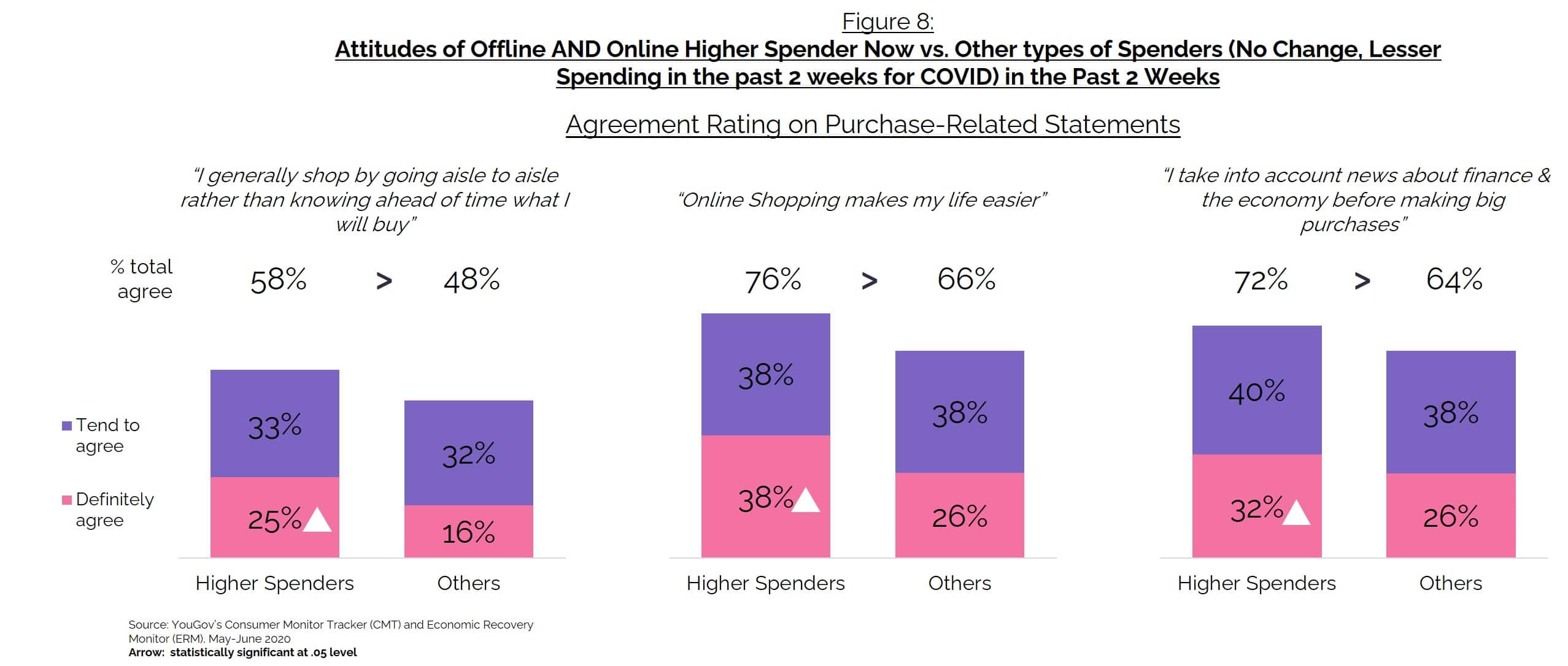

The higher-spending-offline-and-online buyers appear to be skewed to males who probably have been thrust into grocery and other types of shopping but they also tended to be younger and in the mid-to-high income levels. They appear to be flexible buyers as they seem to enjoy doing both offline and online buying. They are careful though in making big purchases and are attuned to finance-based messaging/news. THEY could serve as a model for others to follow.

Given the above mentioned analysis and insights gleaned from YouGov surveys, it is apparent that people want continuity in healthcare services aside from focus on Covid care. The private companies can help in this regard. There are also emerging needs that can already be addressed. Here are some recommendations that mall brands – including its merchants, wherever relevant – can undertake:

1. For malls with extensive branch networks, can consider converting some spaces and attract more clinics and other health-and-wellness services to locate in their malls, i.e., those for non-COVID-related procedures such as vaccinations and simple out-patient procedures.

- Being in a non-hospital environment can be less threatening to the psyche of patients

- If a mall has several branches, travel time could be lesser/shorter for many who are near malls especially since there has been a proliferation of branches for some mall brands in each of the cities in Metro Manila. This enables such clinics to be within ‘arms reach’ of many Filipinos so that quality of life can be addressed while in this pandemic. It likewise addresses reducing the fear of catching COVID while in public transportation as some locations may be close enough that commuting might not be necessary.

- This will serve as traffic ‘drawers’ for the mall for other services and product purchases that are considered as essential these days among those who visit for these health continuity purposes.

- This will likewise portray mall brands to be caring and understanding of consumer needs especially these days.

2. Pre-pandemic, there are already some brands in countries like the US offering grocery delivery convenience through a roving van. Can introduce roving vans that either go from city to city OR dedicate a roving van per city and load these with basic necessities (food/non-food) to serve as mobile supermarkets/grocery-on-wheels. Prioritize areas that are not highly accessible or near the company’s mall or supermarket – to extend the reach of the brand. This will minimize:

- people’s being out for a long time,

- transit time

- fare.

Can also have a different roving van for other favorite items or indulgences (beverages on-the-go or other treats that are food/non-food) for upscale locations. Make the van hygienic, safe and picture-ready to also help spread the word around this. Can partner with LGUs & barangays for these.

3. Considering that high offline spenders tend to also shop online, it may be high time to introduce the following: Virtual shopping – to expand the online supermarket or even introduce a “virtual-video” supermarket (where the shopper can see visuals of actual supermarket shelves) or other essential/non-essential shopping experience to bring the mall ‘nearer’ to its customers

- Could introduce a tour to help customers browse and choose items from the confines of their homes

- Could also introduce a virtual “super” mall online, where shoppers may purchase from any mall merchant anywhere in the country, but would only need 1 mall brand shopping cart. This will provide ease for online shoppers as they would no longer be restricted to nearby malls to purchase online from. The company’s mall merchants can use the physical stores as “localized warehouses” and pick-up points for delivery.

- Mall brand can either provide its own delivery service for online mall purchases or leverage its access to thousands of merchants (and restaurants/food stalls) into affordable delivery rates from existing logistics/delivery providers.

An e-commerce type of app that showcases mall merchants’ good finds but will have the mall brand’s shopping experience into this – ie., like having a mall experience. The mall brand can populate the app with non-supermarket merchants to provide already a ready & easy online selling experience for merchants that customers may have missed during the pandemic.

- Position such app as the app for supermarket items as e-commerce apps may be seen as an app for non-supermarket items.

- Ensure that the shopping experience is engaging, provide the shoppers a sense of discovery and/or fun and create a sense of pride and belonging.

There’s opportunity during these uncertain times for a mall brand to step up and spearhead some private-sector-led initiatives to bring back a sense of normalcy to people’s lives through the abovementioned recommendations. In the process, the malls’ merchants are hoped to also win the hearts of the consumers. These are hoped to put the mall brand at the top of people’s minds and included in their daily lives when the economy fully re-opens.

For more information about the study and the various surveys available; other products/solutions of YouGov; and consultation for building meaningful brands please email info@synergy.ph.

1 Synergy Market Research + Strategic Consultancy provided the analysis, conclusions and recommendations for these sets of data. Synergy is a Philippine-based management consulting and market research company that has been in the market for over 20 years providing evidence-based strategies from research and data analytics to top 1,000 corporations, Fortune 500 companies and SMEs. Synergy is the exclusive partner of YouGov in the Philippines. Synergy has been in the business of consumer insighting to build meaningful brands.

2 COVID-19 Behavior Tracker study covered 29 countries, including the Philippines and other ASEAN countries. Surveys are conducted every two weeks via YouGov’s online platform and started at the end of March/1st week of April and collected every 2 weeks. Latest data is on the week of September 28, and will run till November 2020

3 YouGov is an international research data and analytics group, with a proprietary consumer panel of over 9.6 million people worldwide.

4 The CMT and ERM were conducted weekly, offering relevant metrics measured during COVID-19 situations across global markets such as Australia, China, Indonesia, Japan, Philippines, among others. Surveys were conducted weekly via YouGov’s online platform and for 8 weeks or from 4th May to 28th June 2020, with a total PH respondents of n=8,171 across all 8 weeks.

5 Profiles is a proprietary planning tool of YouGov. It allows target audience segmentation with unrivalled granularity, with thousands of variables from demographics to attitudes, lifestyle & media habits, brand usage and more. Data collection is done regularly per respondent and uploaded/updated every week in YouGov’s platform. 6 Refer to report made by Synergy on “COVID 19 Pandemic: Impact on Filipino Millennials (and Mental Health)” in Synergy Market Research + Strategic Consultancy’s YouTube account.

Germaine A. Reyes is the CEO/President of Synergy Market Research + Strategic Consultancy. Lorenzo D. Reyes is the COO, Synergy Market Research + Strategic Consultancy

Do you have an article, infographic, podcast, presentation slides, press release or a key individual from your organisation that you'd like to highlight on Marketing In Asia? Head on over to Upload Your Content for more info.