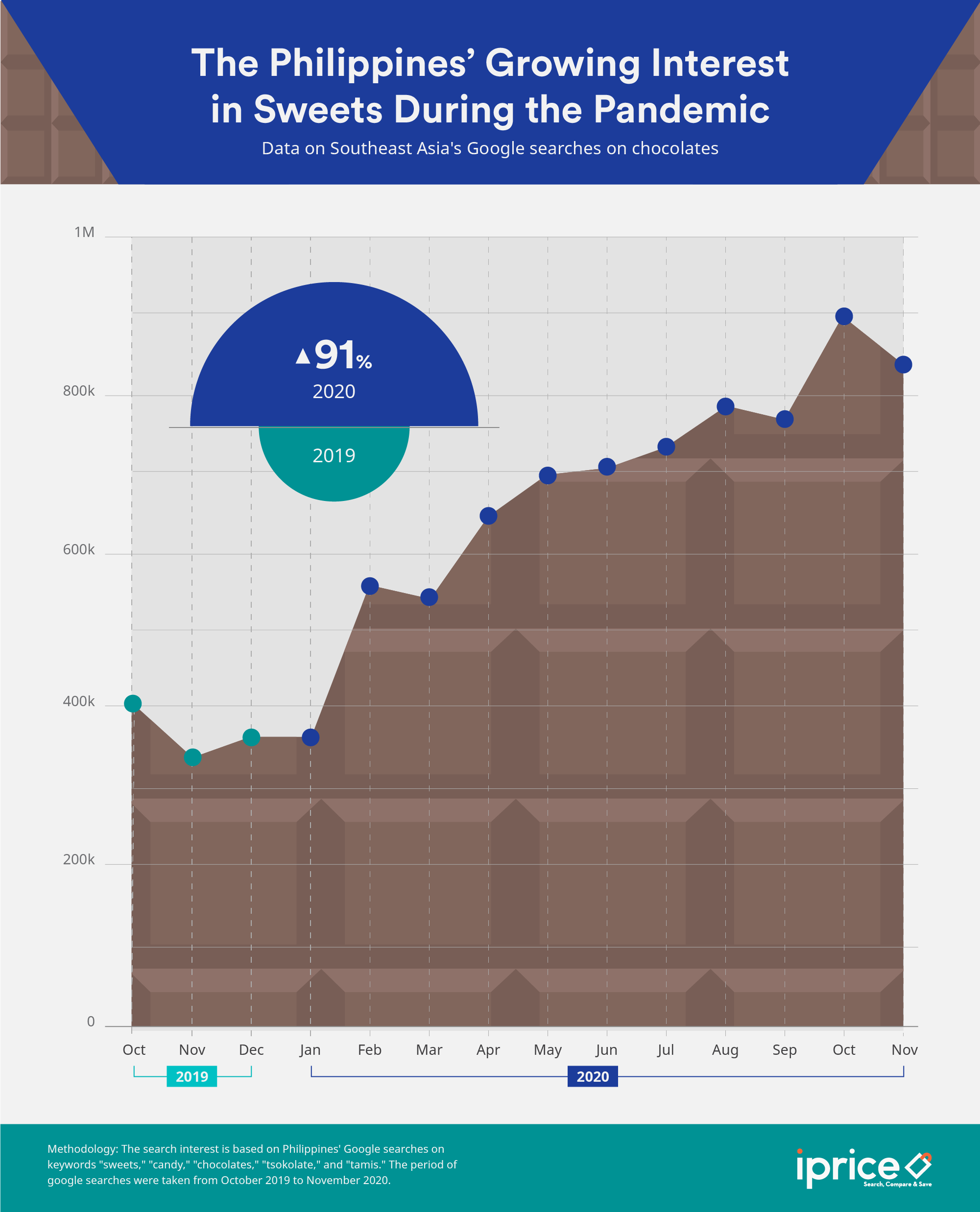

It seems that a little bit of sweetness can help drown out the bitterness that is 2020. According to iPrice Group’s research, the Philippines’ interest in chocolates, sweets, and candy has been on a consistent upward trend since the pandemic started.

In a normal year, February and October would garner the most Google searches on sweets and chocolates due to Valentine’s Day and Halloween. However, this year, Filipinos have been searching more and more for these delicacies as the year went by.

For instance, if you compare September 2020 (a random month) with February 2020 (Valentines’ Day month), September has 38% more Google searches. The number of searches has been on a constant increase over the months. In April 2020, just when everyone was transitioning into the new normal, search interest for chocolates & sweets started to increase by 20%.

But is the data enough to blame the pandemic for this phenomenon? Well, the monthly average of Google searches in 2020 is 91% more than 2019’s. Furthermore, October 2020 (Halloween) has 122% more interest in chocolate than the year before (October 2019). This year-by-year comparison could certainly be a telltale sign.

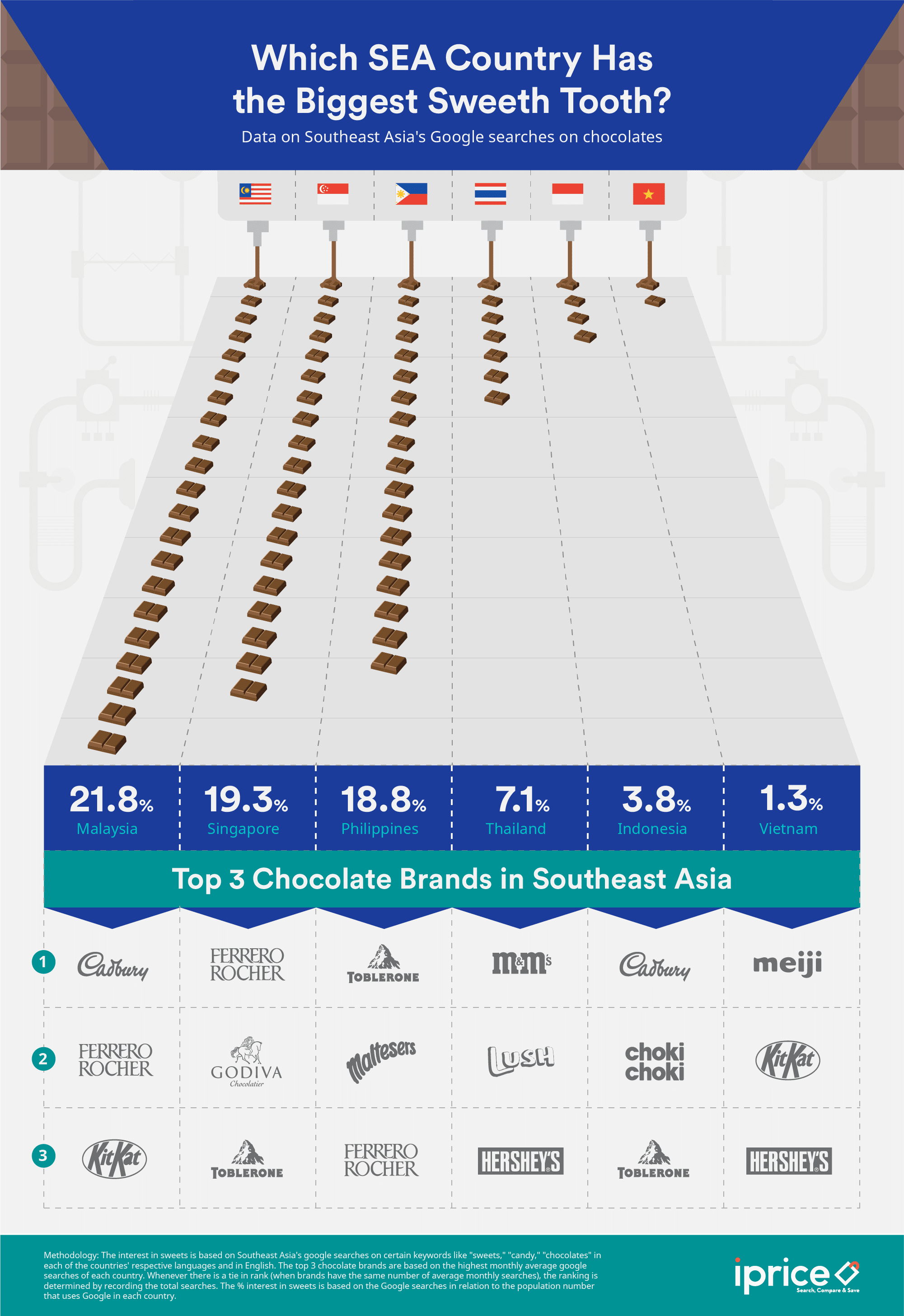

iPrice’s data also shows that the Philippines ranks #3 in Southeast Asia when it comes to interest in chocolates & sweets. Nearly 18.8% of the country’s Google population are looking for sweets, the highest number after Malaysia (21.8%) and Singapore (19.3%). These figures are validated by the International Diabetes Foundation & Diabetes Atlas’ data on diabetes prevalence in Asia. Malaysia ranks #2, while the Philippines is at #24.

Out of all the chocolate brands the e-commerce aggregator recorded, it reveals that Western chocolate brands reign in most of Southeast Asia. In the Philippines, people look for Toblerone, Maltesers, and Ferrero Rocher the most. Its searches are way more than local brands like Chocnut, Flat Tops, and Curly Tops. The top three Western chocolates have 254% more searches than the top three local chocolates. In terms of local chocolates, Philfoods’ Flat Tops rank #1, followed by Chocnut and Curly Tops.

It seems that only Indonesia is the most interested in Southeast Asian chocolates. It has the most search interest in brands from the region. Choki-Choki, a humble liquid chocolate snack in a narrow plastic package, ranks #2 in the country.

To view the original report, visit iPrice.

iPrice curates highly insightful data that are unique and unbiased in the world of tech, e-commerce, and online retail by providing data-rich, interactive, and media-specific targeted content that varies from the latest tech trends to the top e-players in Southeast Asia. They also provide high-quality country-specific insights and data on seven markets, namely Singapore, Hong Kong, Vietnam, Thailand, Indonesia, Malaysia, and the Philippines. Through collaborations with data partners such as App Annie Intelligence, SimilarWeb, and Parcel Perform, iPrice has been featured on numerous prominent publications including South China Morning Post, Bloomberg, Motley Fool, Nasdaq, IGN, and Tech Crunch, to name a few.