MCO 2.0 returned a month before the coming Chinese New Year, marking another indefinite period of lockdown. While Malaysians have to find other means to celebrate, how does this affect their purchasing behavior? This article will briefly talk about the topic at hand, based on the social data in Jan 2021.

Going into the New Year in times like these, it begs to differ on what Malaysians’ opinions are when it comes to celebrating the holiday. According to a recent survey, 47% of the respondents opt to stay, whilst the other 41% choose to return despite the risk. The remaining 12% are on the fence as they anticipate the Government’s next move. This uncertainty and restriction in physical movement is affecting not only how Malaysians celebrate the occasion but also how they spend. Here are a few key aspects worth looking into for businesses:

Comparison between In-Store Sales & Online Sales

Even before the pandemic, Online retail has been an increasing interest for many. The medium of sales has shifted in demand over the years, but the pandemic is forcing physical businesses to reevaluate their strengths and limitations. This causes major headaches for both consumers and business owners alike.

On the other hand, the online platform is able to provide a solution around the physical restrictions and shows a significant increase in activities. This further validates the opportunity for businesses with physical products to utilize online platforms as a means to sell their goods.

Channels of Choice – E-Commerce

While the purchasing behaviour of consumers are clearly shifting in favour of online retailers and stores, there is also a massive increase in the options for consumers to choose from. Established brands are able to hold their own, but other brands find more success in promoting their products on a well known platform. Based on the pre-CNY mentions of e-commerce platforms on Twitter, we uncovered these key findings.

- Before MCO was enforced on 13th January, there was a spike in mentions a few days prior with numbers in the 20s and 30s each day.

- The daily mentions continued to increase going into the latter half of the month with Shopee recording 183 mentions per day, Lazada with 84 mentions and Mudah with 43 mentions.

Seasonal spikes in activities on e-commerce platforms are common and expected, but the effect is compounded with the movement restrictions this time. Malaysians who are not returning to celebrate are resorting to purchasing online and have gifts delivered instead. This makes e-commerce platforms with existing logistic partners and services an enticing option for retailers and manufacturers.

Chinese New Year goods, Which one is the fairest of them all?

On the matter of options, it is also of interest to look into what items consumers are spending the most on. Based by a recent statistics shared by Shopee, here are some key findings:

- Furniture & Decoration, Electronics and Basic Necessities product categories recorded the highest volume of items sold.

- 100 Plus, Fashion and CNY Decorations are among the top most searched items on the platform.

Bird’s nest, abalone, and dried meat are among the top searched items on Shopee as well. This shows that consumers are purchasing not only for their own use but also for families and as gifts. While spending on luxury items is expected to drop, sales in gift items are expected to rise as interstate travels are not permitted to-date. The upward trend for Shopee is expected to peak on February 2nd with its 2.2 CNY Sale.

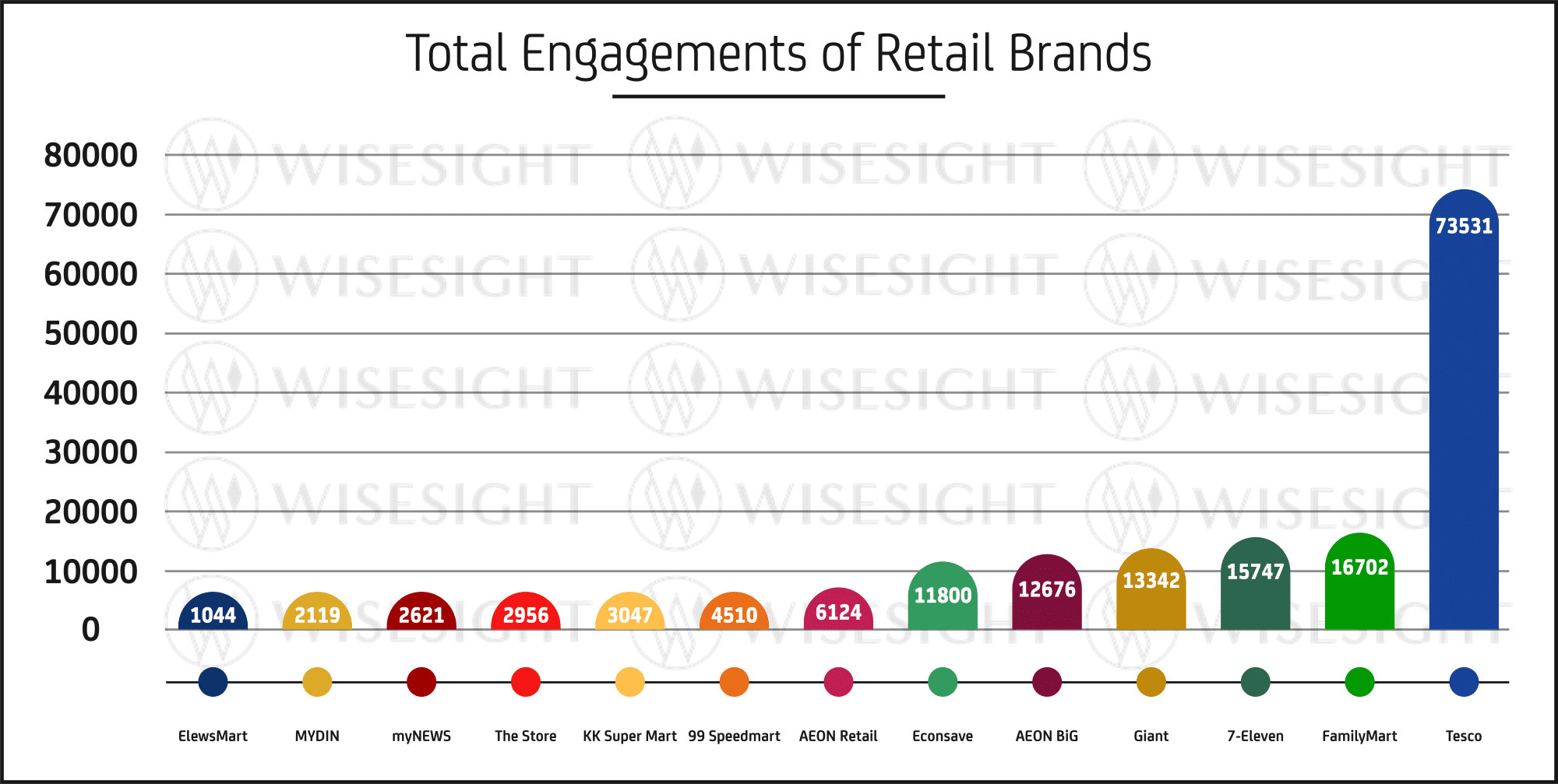

The Engagement among Retail Brands

In another recent study from January 13th to 25th, the engagement on retail brands’ social platforms are bustling with activities. As one of the essential industries, retailers are actively posting their festive promotions online. Here are the stats we found based on CNY contents on their social channels:

- In the 13 days’ period studied, the total engagement for the top 13 brands recorded was 166,219 with an average of 12,786 engagements per day.

- Tesco is in the lead by far with 73,531 total engagements, followed by FamilyMart with 16,702 engagements and 7-Eleven with 15,747 engagements.

The difference in the audience demography and volume of promotional posts contributed largely to the number, however these are interlaced with consumer enquiries and complaints. This signifies that while brands could seize the opportunity to promote festive campaigns, they should also be mindful about concerns raised by the consumers. Higher volume of contents and engagements in this period will also amplify the visibility of complaints and concerns voiced by consumers.

As we brace ourselves through the lockdown, celebrations and traditions will have to adapt. The same applies to businesses in terms of operations and advertising. It should be noted that while the benefit of going online is great given the situation, businesses should still be mindful of the quality of products and services provided especially when it concerns hygiene and SOP compliance. Until the pandemic subsides, the ways we celebrate and the atmosphere of Malaysian festivals will remain a little different from how it used to be.

Wisesight has a multitude of social intel solutions and custom objective research services working with brands across APAC. Drop an email at ask@wisesight.com or chat with us on LinkedIn for social intel or industry studies that enable people-centric-data-based decision making.

iWISERS gives you the power to unlock insights from consumer data across social media spheres. We are an elite social intelligence and digital agency providing various in-depth multi-method research, digital marketing and strategy consulting to change the way organisations in APAC engage their communities. Dive into a more immersive experience with us beyond data to power up your brand. #MadeforAsiabyAsians. Follow them on website and LinkedIn.