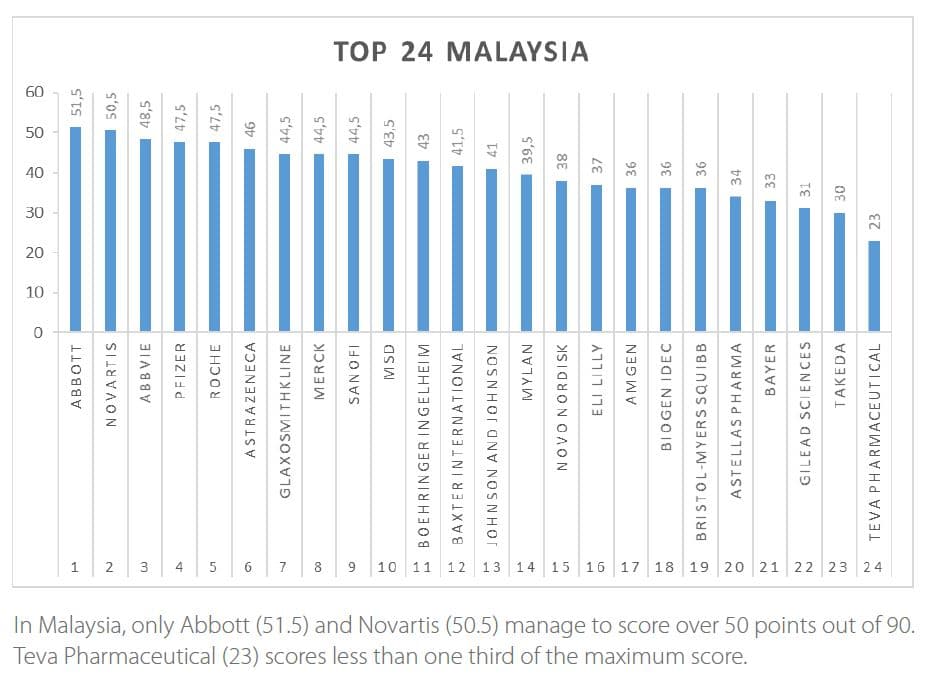

In Malaysia, Abbott, Novartis and Abbvie Have The Most Comprehensive Digital Presence Of The 24 Global Pharmaceutical Companies Tracked

Research executed by The Worldcom Public Relations Group, the leading global partnership of independent public relations firms, concludes that many large pharmaceutical companies are not optimising online and social media communications to their advantage. A relatively large number of relevant online channels are left unused, and the available content has not been distributed and localised effectively, according to findings released in Worldcom’s Healthcare practice group’s annual Digital Health Monitor Report.

Companies missing out on local content opportunity

In the current issue of the Digital Health Monitor – Pharmaceuticals, covering 2020, Worldcom’s research identifies how 24 global pharmaceutical firms manage their online and social media presence globally and in 27 specific countries, including Malaysia.

A rather surprising result of the research is the overall lack of local content. Many of the pharmaceutical companies do not provide local information, even though local content is generally considered of great importance.

In Malaysia, specifically, only two multinational pharmaceutical companies, Abbott and Novartis, achieved a digital presence score in excess of 50 (out of 90). In fact, only 6 of the 24 companies covered by Worldcom’s research in Malaysia, exceeded a score of 45, indicating that many online and social communication opportunities are being missed.

“When you look at the use of the available channels, the 2020 results are quite similar to the results from our first Digital Health Monitor in 2018. As communication experts, we are surprised that pharmaceutical companies have not grabbed the opportunities identified in Worldcom’s last report. Content-wise, we foresee a clear shift to in-depth information.”, said Niall Dologhan, Principal Consultant of TQPR (Malaysia) Sdn Bhd, the Worldcom partner in Malaysia that contributed to the research. “Now, more than ever, people are interested in healthcare-related content. Now is the time for pharmaceutical companies, particularly in Malaysia, to take advantage of the increased interest and engage their audiences with valuable, educational content.”

Key findings

The Digital Health Monitor Report ranks each company in terms of their presence on, and the use of, apps, blogs, corporate and local company websites, Facebook, Flickr, Instagram, LinkedIn, Pinterest, Tumblr, TikTok, Twitter, and YouTube. It also reviewed the use of these channels by country.

Website. All the companies have a global website; however, not every country has its own website – thus are not satisfying the demand for local content. The average number of local sites is 20 out of 27 countries.

Blogs. While almost all pharmaceuticals report having a ‘global blog,’ local blogs are hard to find; the average score is 5.8 out of a possible 27. Where blogs exist, the number of blog posts is moderate.

Apps. The companies have embraced apps more than some other channels. Most pharmaceutical companies have efficient, target group-centered apps.

Social media channels. All the companies, but one, have international Facebook accounts, an international Twitter account is missing in only one (but different) company, LinkedIn is present at the international level, but local pages are not very common. Local YouTube accounts are available in only a handful of countries. The impact of the remaining channels, i.e., TikTok, Pinterest, Flickr, Instagram, and Tumblr, is negligible as the use of, or the engagement on, these channels is under 13%. In all, the effectiveness of the channels, measured by taking criteria into account such as the number of followers and posts, country specific pages, dedicated channels, and updates, is surprisingly low.

Worldcom_Pharma-Monitor-2020-version4Recommendations

The Worldcom Digital Health Monitor Report lists ten recommendations to improve ROI from online communications.

#1 Seize the momentum to build confidence in your company. More than ever, people are receptive to the benefits that come from pharma’s investment in science and innovation.

#2 Use the heightened interest in pharma caused by the pandemic to build belief in your company. Communicate your WHY and your HOW.

# 3 Communicate about the benefits of your products for the public. To be effective in pharma, localised content equals personalized, in-depth content.

#4 Review your use of digital channels. Ask yourself if you want to be relatively invisible on many channels or make a real impact on a limited number of channels.

#5 Don’t be afraid to try something new. Make use of the new channels and ways of communicating.

#6 Make sure to be present at both a global and local level, with content that has been tailored to the countries you work in.

#7 The importance of non-text content continues to increase. Consider focusing more on videos, infographics, and podcasts to create higher levels of engagement and belief in your WHY and HOW.

#8 Invest in content marketing and in in-house staff or agencies to handle it for you.

#9 Global confidence in the healthcare sector is high, according to the Worldcom Confidence Index Check the WCI to identify the specific topics and subjects that the global C-suite is confident or concerned about and use this insight to guide your communications strategy.

#10 Take advantage of Worldcom’s offer of a free workshop to identify options for enhancing your social presence.

The full report can be downloaded via Digital Health Monitor Link.

Additional information

Countries

The study covers 27 countries: Australia, Belgium, Bulgaria, Canada, Colombia, Czech Republic, Dominican Republic, Ecuador, France, Germany, Hungary, Ireland, Italy, Kenya, Malaysia, Netherlands, Peru, Poland, Portugal, Russia, South Africa, Spain, Sweden, Thailand, Turkey, United Kingdom, United States.

Pharmaceutical companies

The 24 pharmaceutical companies included in the study are: Abbott, AbbVie, Amgen, Astellas Pharma, AstraZeneca, Baxter International, Bayer, Biogen Idec, Boehringer Ingelheim, Bristol-Myers Squibb, Eli Lilly, Gilead Sciences, GlaxoSmithKline, Johnson and Johnson, Merck, MSD, Mylan, Novartis, Novo Nordisk, Pfizer, Roche, Sanofi, Takeda and Teva Pharmaceutical.

Do you have an article, infographic, podcast, presentation slides, press release or a key individual from your organisation that you'd like to highlight on Marketing In Asia? Head on over to Upload Your Content for more info.