- The influx of multinational companies seeking regional headquarters in KL is contributing to a more competitive office landscape, boosting overall occupancy rates and rental values in prime locations.

- India’s key markets Mumbai and Bengaluru lead regional growth, with record-breaking volumes

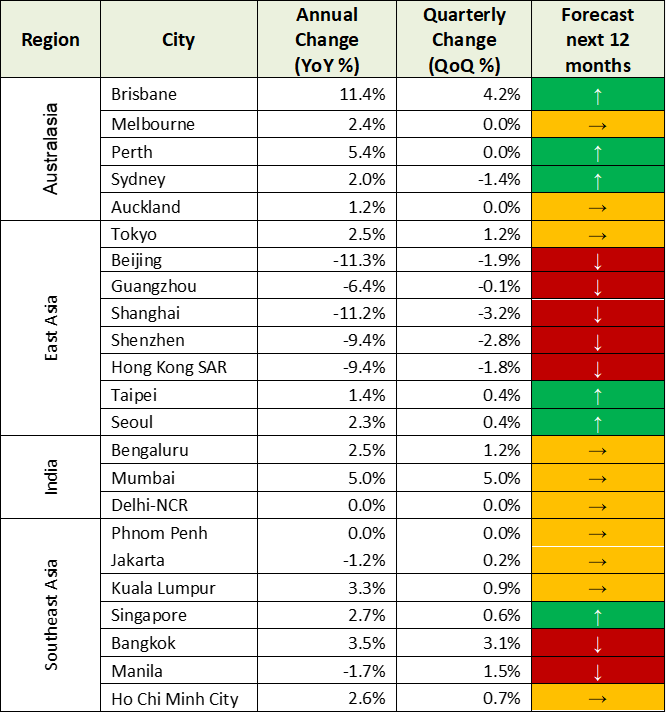

- Cities on the Chinese mainland remain the primary drivers of the region’s rental decline, with an 11% year-on-year decrease steeper than the 10.6% reduction in Q2 2024

Global property consultancy Knight Frank’s Asia-Pacific Prime Office Rental Index for Q3 2024 shows prime office rents in Asia-Pacific are stabilising, falling 0.1% quarter-on-quarter, suggesting a potential bottoming out of the market. This trend is supported by growth in Indian markets, which exhibit strong and sustained demand from offshoring operations and domestic businesses.

Key findings for Q3 2024:

- Sixteen out of the 23 monitored cities reported stable or increasing rents year-on-year, up from 15 in Q2 2024, with rents in Bangkok now posting an increase.

- Year-on-year, rents declined 2.5%, an improvement from the 2.8% drop observed in Q2 2024.

- Rental growth was led by Brisbane at 11.4% year-on-year.

- Cities on the Chinese mainland remain the primary driver of the region’s rental decline, with an 11% year-on-year decrease steeper than the 10.6% reduction in Q2 2024.

- Regionwide vacancies are stabilising, falling marginally 0.2 percentage points quarter-on-quarter to 14.8% to halt consecutive quarterly increases since Q2 2022.

Teh Young Khean, Executive Director of Office Strategy & Solutions at Knight Frank Malaysia, says, “We remain positive on the office market outlook, with notable multinational companies expanding and setting up business in Malaysia (especially Kuala Lumpur) due to its competitive real estate cost and welcoming business environment.

Despite higher vacancy rates among APAC region, KL City continue to show steady signs of improved occupancy rate and rental rates of prime grade buildings from quarter-to-quarter.”

Tim Armstrong, global head of occupier strategy and solutions, says, “Global economic uncertainties have led to more cautious capital expenditure strategies among occupiers, favouring renewals and consolidating office footprints. When relocations do occur, companies are opting for smaller, higher-density spaces, aligning with cost mitigation needs and the growing acceptance of hybrid work models. While the business sentiment may improve as the Fed eases monetary policy, demand will continue to be tempered by prudent spending and workplace strategies focused on maximising space utilisation.

However, as the region’s development peak subsides, any significant uptick in leasing activity could rapidly tighten the availability of prime spaces. This scenario may accelerate the flight-to-quality trend as tenants seek to upgrade their portfolios in a potentially more competitive market.”

India’s thriving office market is key in driving regional growth, with Mumbai, Bengaluru, and the National Capital Region (NCR) setting consecutive quarterly records in Q2 and Q3 2024, as occupier demand remains strong in tandem with slow office supply. The growth is primarily fueled by two key segments: Global Capability Centres (GCCs) and India-facing businesses. Bengaluru stands out as a market leader with a 158% year-on-year increase in transaction volumes in Q3 2024.

While the Asia-Pacific prime office sector is expected to remain tenant-favorable in 2024, market dynamics may shift. The projected 20% decrease in the 2025 supply pipeline could gradually reduce availabilities, potentially creating a more competitive environment for prime spaces.

Chistine Li, head of research, Asia-Pacific, Knight Frank, says, “Despite the delivery of over one million sqm of new supply, regional vacancy dipped marginally in the third quarter, which halted eight consecutive quarters of rises. Rental declines also moderated, dropping by just 0.1% quarter-on-quarter, which indicated that the rental downtrend in the region could be bottoming out. Overall rents in the region were held up by Indian cities, as occupier demand continued to remain robust in tandem with a slowing supply pipeline. While occupiers remain cautious, there is continued interest in newer and quality spaces that prioritise sustainability. Given lower new supply in 2025, vacancy rates can be expected to fall gradually. However, rental growth will remain subdued, with tech firms still right-sizing their headcount and intense competition for tenants in mainland Chinese markets.”

Forecast for the next 12 months:

The full report can be found here.

About Knight Frank Malaysia

Knight Frank Malaysia offers high-quality professional advice and solutions across a comprehensive portfolio of property services and is registered with the BOVAEA since its establishment two decades ago. The brand has embraced a growth strategy based on “Partners in Property” and remains firmly focused on the future. The Company is licensed to undertake property, valuations/consultancy, estate agency, and property management and is also on the panel of all leading banks and financial institutions. Having a strong presence in Malaysia with its headquarters in Kuala Lumpur as well as branches in Penang, Johor Bahru, Kota Kinabalu and Miri, the Company will continue to engage with stakeholders to help shape global success in real estate markets in the years to come. For further information about the company, please visit www.knightfrank.com.my