In the business world, companies use different financial metrics to show how much money they are making and how profitable they are. While Generally Accepted Accounting Principles (GAAP) is the most commonly used set of accounting rules, standards, and procedures followed by public companies in the US, many companies resort to non-GAAP accounting to make their earnings releases look more attractive. But investors and analysts can be misled by the use of these metrics, so it is important to know what happens when non-GAAP accounting is used.

What is Non-GAAP Accounting?

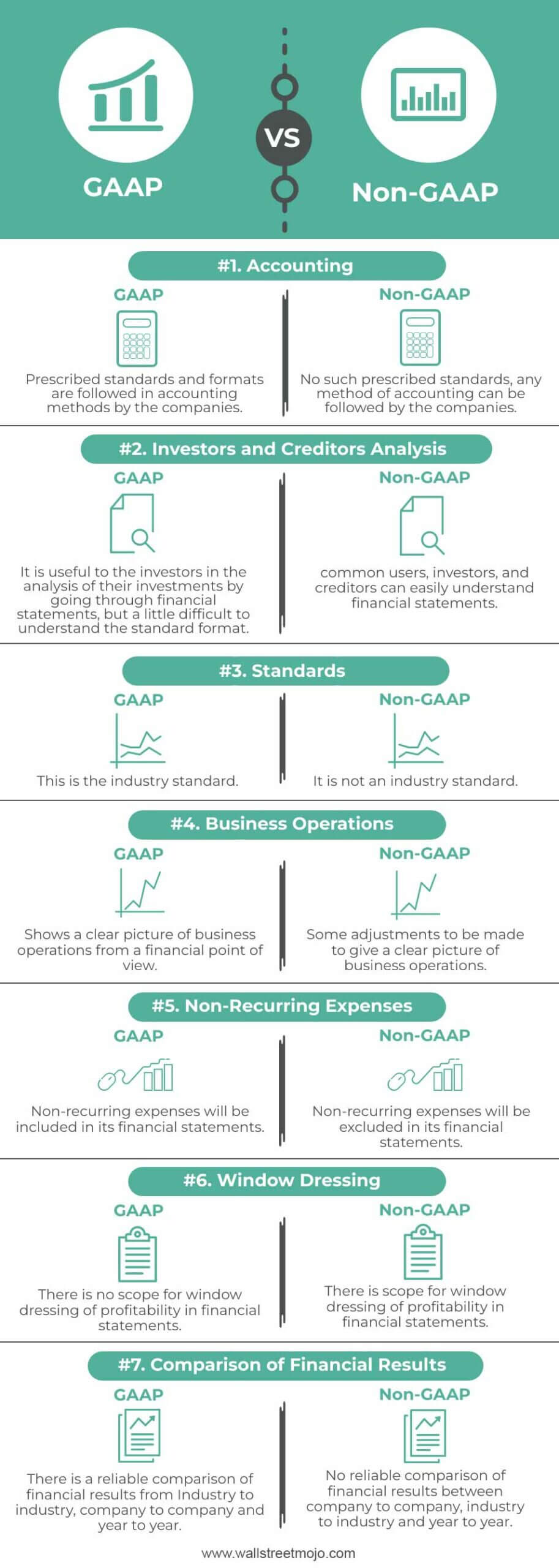

Non-GAAP accounting refers to a set of financial metrics that companies use to report their earnings and profitability, which do not follow Generally Accepted Accounting Principles (GAAP) principles. The usage of non-GAAP metrics can make the company’s financials appear better than they actually are, leading to inflated stock prices and overvalued companies. Such metrics are designed to exclude certain expenses and items that are deemed to be non-recurring or irrelevant to the company’s core operations. However, the implications of using non-GAAP metrics go beyond misleading investors.

One notable example of non-GAAP accounting is WeWork’s co-founder and CEO Adam Neumann’s use of the metric “Community-adjusted EBITDA” in the bond-offering document released in April 2018, which reported earnings of $233 million.

Valeant Pharmaceuticals released its financial numbers in 2015. It is said that the company has been using non-GAAP metrics for years. While the company reportedly had a GAAP loss of $291.7 million, it reported an “adjusted” non-GAAP profit of $2.84 billion.

In the same year, another US company, online lender LendingClub, reported a GAAP loss of $5 million but a non-GAAP net income of $56.8 million.

Indian companies are also adopting non-GAAP accounting to report their financial numbers. For example, in February 2022, online food delivery firm Zomato turned “adjusted EBITDA positive” for the month of January. Paytm also recently reported its first adjusted EBITDA positive quarter. Edtech firm Byju’s reportedly adopted a new revenue recognition norm while reporting its last financial numbers after a delay of 18 months. While 40 percent of its revenue in FY21 was deferred to subsequent years, the net loss reportedly widened to Rs4,588.75 crore for FY21 from a comprehensive loss of Rs231.69 crore in FY20.

Non-GAAP Reporting: The Gray Areas

In the past few years, non-GAAP accounting has become more popular among companies. Many use these metrics to show their financial performance in a better light. One grey area in non-GAAP reporting is the exclusion of certain expenses and items that are deemed non-recurring or irrelevant to the company’s core operations. For example, Valeant Pharmaceuticals stripped out amortisation of intangible assets, acquisition costs, and other expenses to arrive at the adjusted profit number.

Another grey area is the lack of standardisation in non-GAAP accounting, which can lead to inconsistencies in financial reporting and make it difficult to compare companies in the same industry. For instance, WeWork’s “Community-adjusted EBITDA” metric measured net income before interest, taxes, depreciation, and amortisation, as well as “building- and community-level operating expenses,” which reportedly included rent, tenancy expenses, utilities, internet, salaries of building staff, and the cost of building amenities. This non-standard metric made it challenging for investors and analysts to compare WeWork’s financial performance with that of its peers.

Implications of using non-GAAP metrics

The implications of using non-GAAP metrics go beyond misleading investors. It can also create confusion and inconsistency in financial reporting, making it difficult to compare companies in the same industry.

Moreover, non-GAAP accounting can be used to manipulate earnings and hide unfavourable financial results. By excluding certain expenses or items from their financial reports, companies can make their earnings look better than they actually are, leading to inflated stock prices and overvalued companies.

How is India addressing the challenge?

Today, India is a hotbed of startups. Therefore, it is crucial to shield the Indian startup ecosystem from such malpractices. In recent years, Indian regulators have taken steps to combat the use of non-GAAP accounting practises by companies. In 2016, the Securities and Exchange Board of India (SEBI) issued guidelines for the use of non-GAAP measures in financial reporting, mandating that companies provide a reconciliation of non-GAAP measures to their corresponding GAAP measures. The guidelines also require companies to disclose the rationale for using non-GAAP measures and explain how they are useful to investors.

Also, the Institute of Chartered Accountants of India (ICAI) has given advice on how to use non-GAAP measures, stressing how important it is for financial reporting to be clear and consistent. The ICAI has also asked for more oversight of non-GAAP measures by regulators to make sure they aren’t used to trick investors.

Also, the Ministry of Corporate Affairs (MCA) has taken steps to make financial reporting in India more open and trustworthy. The MCA put out a new auditing standard in 2020 called SA 720. This standard says that auditors must report on key audit matters (KAMs) that are important to investors. KAMs are things that auditors need to pay a lot of attention to, like areas with a high financial risk or complicated accounting issues.

Also read: The Booming Indian Startup Industry: A Bright Future Ahead

In response to the growing use of non-GAAP accounting, the US Securities and Exchange Commission (SEC) has taken steps to regulate its usage. In 2016, the SEC came out with new rules that say companies have to give more information about their non-GAAP metrics and explain how they fit in with their GAAP results. Companies must also explain why they think the non-GAAP metric gives investors useful information and how it differs from the GAAP metric.

Even though non-GAAP accounting is not against the law, companies should be honest about how their finances are doing and give investors a clear picture of how they are doing. Before investing, investors and analysts need to look closely at non-GAAP metrics and understand what they mean. Standardising non-GAAP accounting would also help to make financial reporting more clear and consistent.