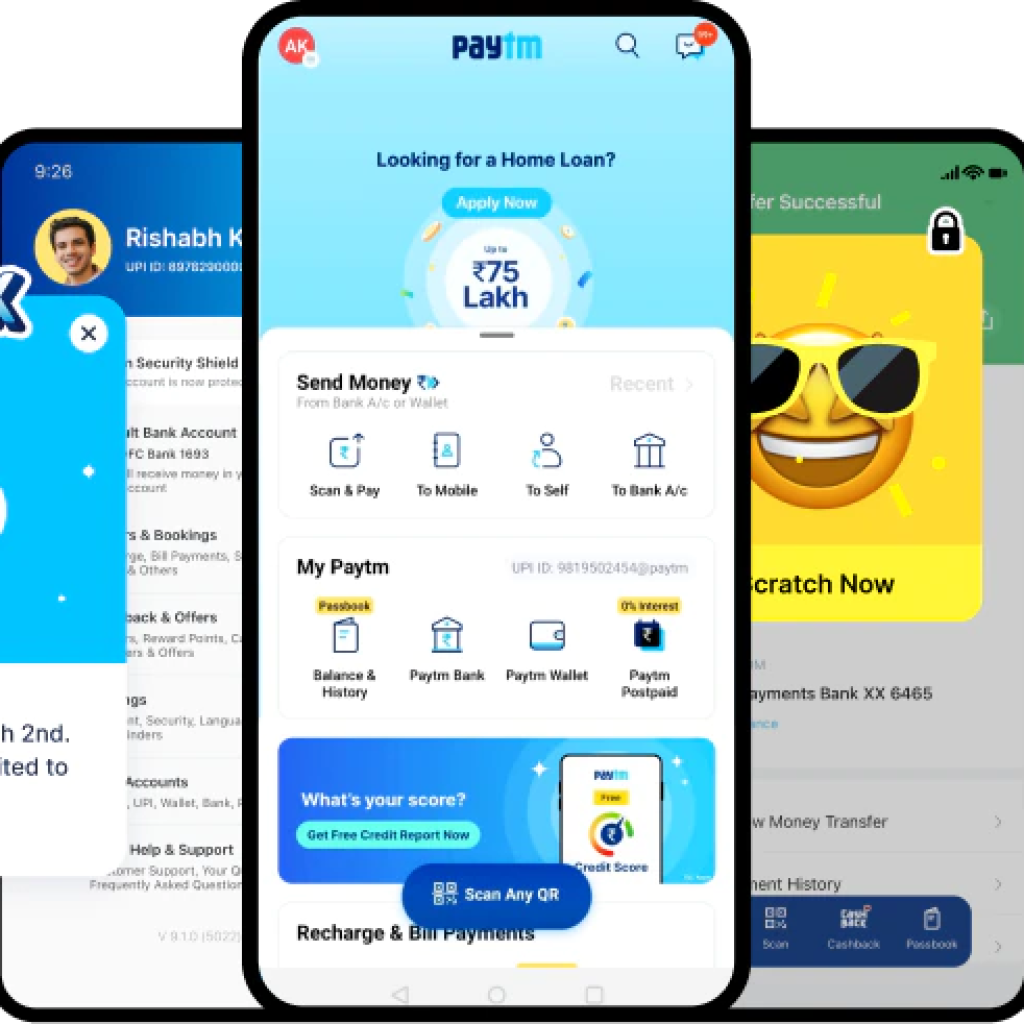

In order to comply with SEBI regulations, Ant Group, the Jack Ma-backed Chinese fintech giant, reportedly considers selling a portion of its 30% stake in Paytm, a significant Indian digital payment processor. Ant is in discussions to reduce its ownership in One97 Communications, the parent company of Paytm, to less than 25%. Ant has not yet started a formal sale process, and the financial terms of the potential deal have not been settled. At the time of its most recent private fundraising round, Paytm had a valuation of roughly $16 billion, making Ant’s ownership stake in the company worth about $4.8 billion.

Ant’s possible departure from Paytm would be another setback for the company. Which just had to stop the largest stock listing in the world, which was worth $37 billion. It could also be a setback for Ant’s goal of getting ahead of the competition in the payments world. Ant seems to have been thinking about Paytm because of how relations between India and China have been getting worse lately. India has banned dozens of Chinese mobile apps, including ones from tech giants Tencent, Alibaba, and ByteDance. It has also made it harder for Chinese companies to invest in India. According to sources, Chinese investors like Alibaba and Tencent have provided significant funding to Indian startups. Bankers have said in the past that they wanted to grow their business in India. So they could make more money outside of China. Alibaba has already spent over $4 billion in India. But it has postponed plans to spend about $5 billion by 2021.

Also Read: DHL Supply Chain Appoints Andries Retief as CEO for South East Asia

Another probable reason why Ant is thinking about reducing its stake in Paytm is the increasing level of market competition in India. In India, e-wallet, lending, and other online services have been growing quickly. Thanks to government initiatives to promote the use of digital payments. Google and WhatsApp, both owned by Alphabet, have also entered the market. According to Ant’s initial public offering prospectus. Which referred to the Indian company as a major associate, the company received its first investment from Ant in 2015. Ant now owns a 30% stake through One97 Communications, the parent company of Paytm. Sources claim that Ant might still hold a small stake in Paytm after the investment review, though.