ASEAN’s Economic Landscape: A Mixed Bag

The ASEAN region, known for its dynamic economies, is currently navigating through turbulent waters. Recent data suggests a potential slowdown, influenced by various global and domestic factors. From China’s post-pandemic recovery deceleration to the ripple effects of the US Federal Reserve’s interest rate hikes, the region faces multifaceted challenges.

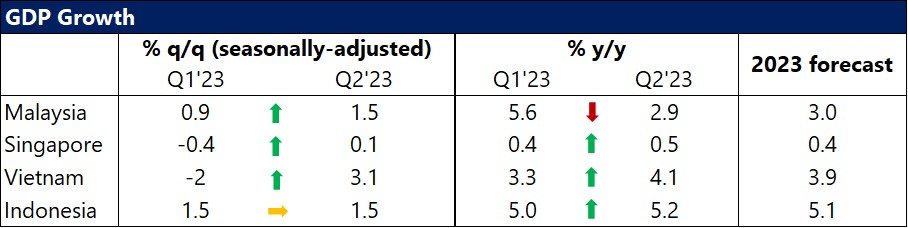

Oxford Economics, in a study commissioned by the Institute of Chartered Accountants in England and Wales (ICAEW), indicates a more pronounced growth slowdown in Q3. Despite witnessing mixed GDP growth in the previous quarter, the ASEAN-6 nations (Malaysia, Indonesia, Philippines, Singapore, Thailand, and Vietnam) are projected to experience a dip in growth rates.

Unraveling the Factors Behind the Slowdown

Several elements contribute to the anticipated deceleration:

- China’s Recovery Pace: The once-rapid post-pandemic recovery of the Chinese economy is losing steam, leading to downward revisions in growth forecasts.

- US Federal Reserve’s Actions: The 550bps rate hike by the US Federal Reserve and its subsequent impact on ASEAN interest rates is yet to be fully realized.

- Semiconductor Sector: Weak semiconductor prices are particularly affecting nations like Singapore and Malaysia.

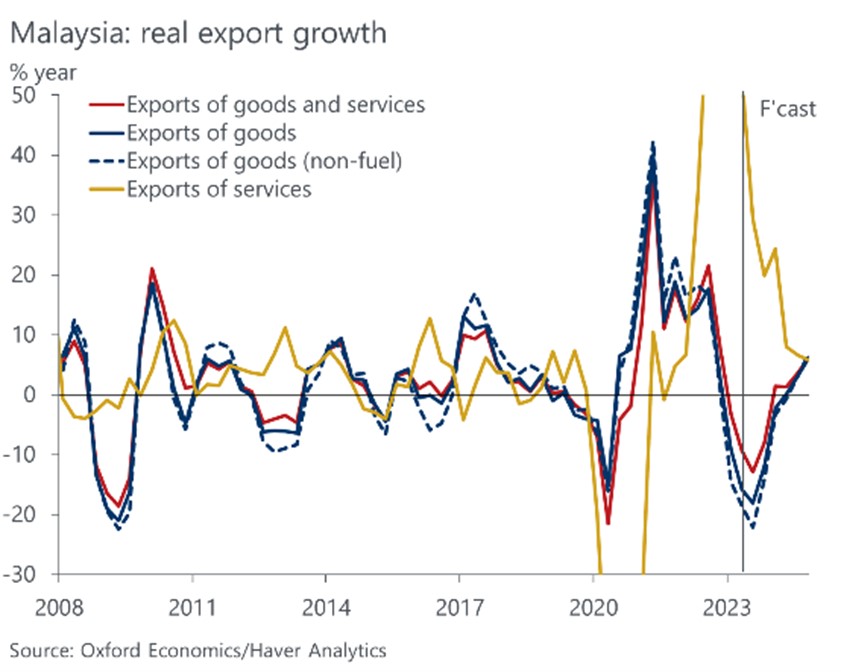

- Export Sector Dynamics: After an initial boom during the pandemic’s early days, the export of goods has seen a decline. The shift in global demand from goods to services is a significant contributor to this trend.

Malaysia’s Economic Outlook: A Silver Lining Amid Challenges

Despite the broader regional challenges, Malaysia’s economic landscape offers a glimmer of hope. The nation’s diverse sectors, especially tourism, hint at potential recovery and growth. While the recent GDP growth deceleration is notable, the strength of domestic demand and the resurgence of the travel sector provide a cushion.

However, the export sector, particularly in relation to China, poses challenges. With China’s economic data showing signs of deterioration, the ripple effects are felt across the region. Yet, Malaysia’s projected GDP growth of 3% for the year, following an impressive 8.7% in 2022, showcases the nation’s resilience.

Inflation Trends and Central Bank Responses

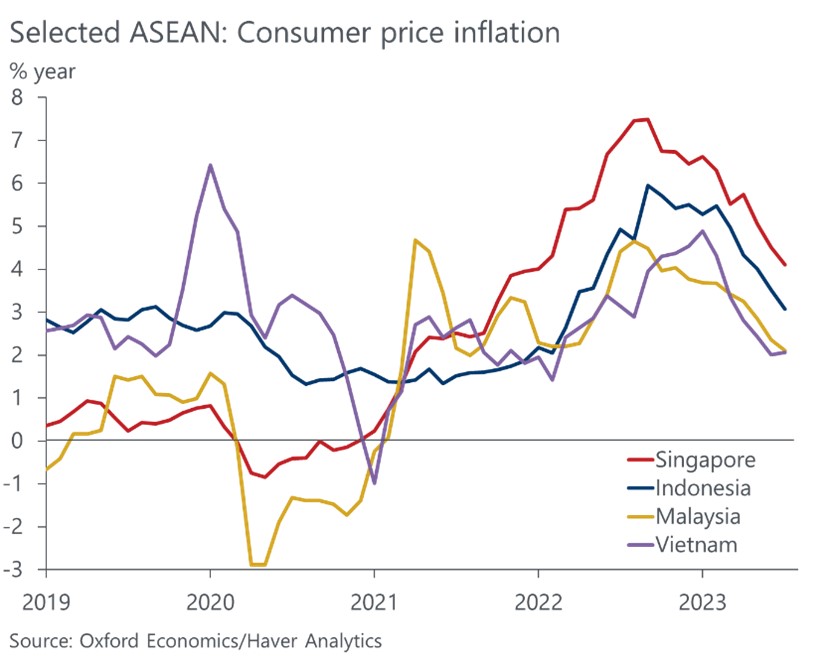

Inflation trends across the ASEAN region are on a downward trajectory. The forecasted CPI inflation for South-East Asia stands at 3.5% for the current year, a decrease from 4.6% in 2022. This trend is expected to continue, with projections pointing to a further decline to 2.4% in 2024.

Central banks in the region are adjusting their strategies in response. While some, like the State Bank of Vietnam, have already initiated rate cuts, others are expected to follow suit. However, China’s rapid economic slowdown might delay these rate adjustments, potentially exerting pressure on ASEAN currencies.

Key Highlights from the Economic Update Q3 2023

- Singapore: The nation’s economy contracted in the first half of the year, with growth largely dependent on global demand. Policy easing is anticipated by early 2024.

- Indonesia: The export sector remains a concern due to global economic deceleration. However, domestic demand has shown resilience, which might wane as the effects of monetary tightening become more pronounced.

- Vietnam: The country witnessed a robust Q2 GDP growth, primarily driven by the construction sector. While the real estate sector’s risks have diminished, weak global demand remains a concern.

Also read: Live the Life You Please: A Cinematic Revolution in Understanding Palliative Care

While the ASEAN region faces its share of challenges, the resilience and adaptability of its economies cannot be underestimated. As global dynamics shift, the region’s nations are poised to navigate the complexities and chart their path forward.

Legal Disclaimer: The Editor provides this news content "as is," without any warranty of any kind. We disclaim all responsibility and liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. For any complaints or copyright concerns regarding this article, please contact the author mentioned above.