A Landmark Partnership for Financial Inclusion

CTOS Data Systems Sdn Bhd (“CTOS”) has inked a pivotal cooperative agreement with Kekal Impian Sdn Bhd (“Kekal Impian”), setting the stage for a transformative impact on Malaysia’s digital moneylending landscape. This collaboration comes on the heels of Kekal Impian securing a digital moneylending license from KPKT, Malaysia’s Ministry of Housing and Local Government.

Elevating Moneylending Through Digital Automation

The alliance centers around the deployment of CTOS Application and Decisioning for Moneylenders, a state-of-the-art digital automation solution designed to streamline Kekal Impian’s online moneylending operations. This innovative platform is powered by JurisTech, a fintech company in which CTOS acquired a 49% stake last year.

Erick Hamburger, Group CEO of CTOS Digital Berhad, remarked, “We have long evolved from being a traditional credit reporting agency into a company that provides a broad suite of innovative end-to-end digital credit decisioning and management solutions. Today’s partnership with Kekal Impian is another important milestone for CTOS in this regard. Our latest iteration, CTOS Application and Decisioning for Moneylenders, powered by Juristech, and embedded with CTOS eKYC and comprehensive bureau data, shows how CTOS has grown to truly be a digital enabler.”

Expanding Reach and Enhancing Convenience

Previously confined to the Johor region, Kekal Impian is now poised to extend its services nationwide, courtesy of this new digital platform. The technology will empower the company to offer faster, more convenient, and personalized financial services to a broader audience, both online and remotely.

Steven Phua of Kekal Impian shared his insights, stating, “We started as a traditional venture in the financial industry, driven by a simple yet powerful mission: to provide a helping hand to those facing financial difficulties. With the support of CTOS, we will be moving forward as a digital moneylender with the capability to extend our services nationwide, reaching a broader audience than ever before.”

Also read: Malaysia’s Forex Market Booms: Over 2.2 Million Investors and Counting

A Robust Engine for Financial Transformation

The Kekal Impian system is built on a robust engine platform furnished by JurisTech. Known for delivering enterprise-level solutions, JurisTech has been instrumental in driving digital transformation across banks, financial institutions, and telecommunications companies.

A Step Towards Financial Inclusion for All

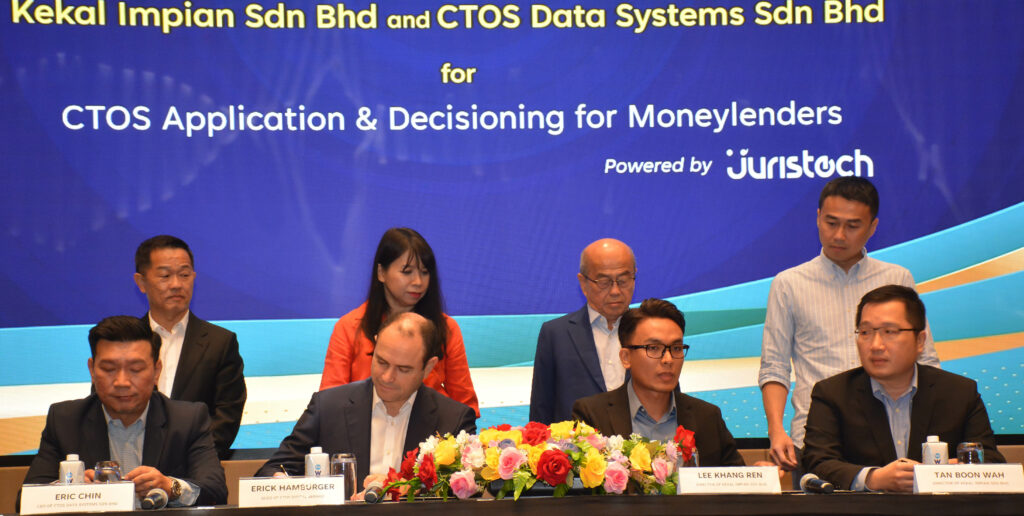

(L-R) (Behind): Jason Ng, See Wai Hun, Tan Sri See Hong Chen and See Cherng Jye

The partnership between CTOS and Kekal Impian aligns with broader initiatives to improve financial inclusion across Malaysia. As Erick Hamburger emphasized, “There are still many people who do not have easy access to credit through the traditional banking system. Digital moneylenders like Kekal Impian provide a vital alternative to these underserved and unserved segments, which can only benefit both individuals and the economy as a whole. Being in a position to do our part in enabling the government and KPKT’s vision, coincides with our mission to improve credit health and financial inclusion across Malaysia.”

This groundbreaking collaboration promises to be a game-changer in the digital moneylending sector, setting new standards for convenience, reach, and financial inclusion.

Legal Disclaimer: The Editor provides this news content "as is," without any warranty of any kind. We disclaim all responsibility and liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. For any complaints or copyright concerns regarding this article, please contact the author mentioned above.