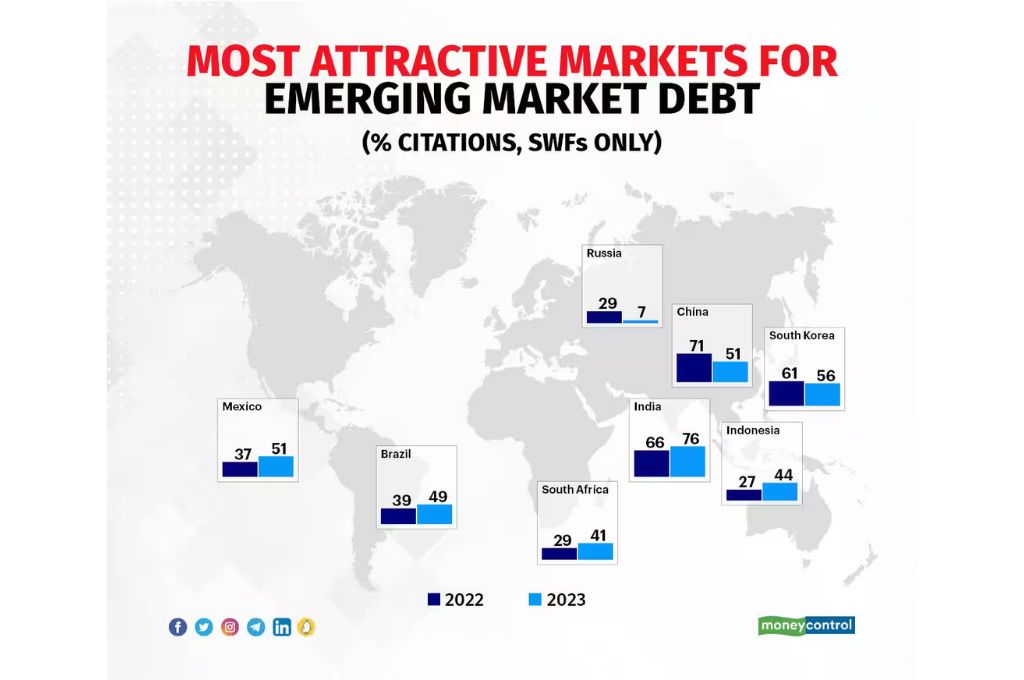

The rise of Emerging Markets, with India at the helm, heralds a seismic shift in the global investment climate. Over the last decade, the annual study by Invesco, a leading independent investment management company, has chronicled the fluctuating sentiments of sovereign wealth funds towards Emerging Markets. The 2023 Invesco study highlights a surge in interest in Emerging Markets, underpinned by the normalisation of interest rates.

Historically, most sovereign investors held relatively low allocations in Emerging Markets as Developed Markets’ asset prices surged due to cheap money and negative real interest rates. However, the tide is turning, as rising interest rates prompt sovereign investors to cast their nets wider.

The study identifies Emerging Markets across Asia, Latin America, and Africa as appealing destinations for investors looking for diversification and higher returns. Respondents lauded these markets’ resilience amidst increasing interest rates, indicative of institutional strength honed over the last decade. Their optimism is also buoyed by the potential for substantial investments in sectors like healthcare, education, and infrastructure.

Emerging Markets, notably Africa, are becoming increasingly appealing to sovereign investors from the Middle East, drawn to their robust growth trajectories and the untapped potential in sectors like health, agribusiness, and infrastructure.

Yet, it is India that stands out as the epitome of the attributes sought by sovereign investors. India has now outshone China as the most attractive Emerging Market for debt investment. The country’s growing appeal stems from improved business and political stability, favourable demographics, regulatory initiatives, and a conducive environment for sovereign investors.

A development sovereign based in the Middle East opined, “We don’t have enough exposure to India or China. However, India is a better story now in terms of business and political stability. Demographics are growing fast, and they also have interesting companies, good regulation initiatives, and a very friendly environment for sovereign investors.”

India, along with Mexico and Brazil, are also reaping the benefits of increased foreign corporate investment aimed at domestic and international demand through “friend-shoring” and “near-shoring”. This trend is funding current account deficits, supporting currencies, and bolstering domestic assets, including debt.

As we look ahead, the study predicts that peaking inflation and completion of the Emerging Markets tightening cycle will further fuel this trend. Countries like Brazil and Indonesia, integral to the green transition and electric vehicle revolution, offer valuable diversification opportunities for sovereigns with concentrated commodity revenue streams.

In conclusion, the sovereign investment landscape is shifting towards Emerging Markets, with India emerging as a beacon of stability and growth. The nation’s improved business environment, favourable demographics, and regulatory initiatives make it an attractive destination for sovereign investment.