Welcome to our exciting new series, “Falling Giants: Bankruptcy Uncovered“. In this journey, we’ll be looking at big companies that had lots of money and power but still ended up in a financial mess called bankruptcy. It’s like a detective story where we try to figure out what went wrong, who was affected, and what we can learn to avoid such troubles in the future.

Our first story is about Jet Airways, a big airline company that everyone thought was doing really well. Imagine if your favorite superhero suddenly lost all their powers – that’s kind of what happened with Jet Airways. One day it was flying high, and the next, it was crashing down. This left everyone shocked and confused.

So buckle up for our first deep dive into the story of Jet Airways and stay tuned for many more to come!

Ascending Heights: Jet Airways’ Rise to Prominence

When Naresh Goyal and his wife, Anita Goyal, launched Jet Airways in 1993, they did so in a nascent Indian aviation market that was ripe for disruption. Jet Airways quickly became the airline of choice for a burgeoning middle class that sought reliable and comfortable air travel. By 2010, Jet Airways had skyrocketed to the top, claiming the throne as India’s largest airline in terms of passenger numbers. The airline’s success in this era represented a beacon of ambition and the realization of a vision that seemed to encapsulate the possibilities of the Indian dream.

Dark Clouds on the Horizon: The First Signs of Financial Woes

The economic weather began to shift in the early 2010s, bringing with it a challenging environment for Jet Airways. The company faced a headwind of mounting problems:

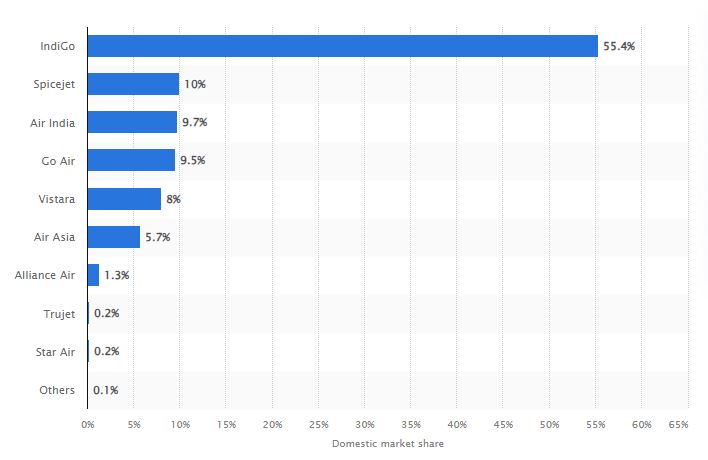

- An increasingly competitive market landscape saw the rise of budget airlines like IndiGo and SpiceJet, which offered travelers significantly cheaper alternatives. These low-cost carriers had a leaner business model that allowed them to operate at lower costs.

- A surge in fuel prices globally significantly hiked Jet Airways’ operating costs, putting pressure on their profit margins.

- A steadily weakening Indian rupee exacerbated the situation by increasing the cost of importing essential aircraft parts and servicing the airline’s dollar-denominated debt.

By 2013, the cumulative impact of these challenges had pushed Jet Airways to the precipice of bankruptcy.

A Lifeline from the Sands: The Etihad Airways Investment

In a bid to save Jet Airways, Etihad Airways, the national airline of Abu Dhabi, came to the rescue with a $200 million investment. It gave Jet Airways a much-needed infusion of capital and a temporary reprieve. However, it fell short of a comprehensive solution to Jet Airways’ deep-rooted financial problems, serving only as a stopgap rather than a remedy.

The Descent Begins: The Unraveling of Jet Airways

Fast forward to 2018, and Jet Airways found itself in an even more precarious position. Efforts to raise additional capital proved futile, and a cash crunch forced the airline to ground several aircraft. The crisis reached its apex in April 2019 when Jet Airways, crippled by debt and operational issues, suspended all operations.

Also read: Falling Giants: Bankruptcy Uncovered – The Downfall of Anil Ambani’s Reliance Communication

The fallout from Jet Airways’ bankruptcy sent shockwaves through the Indian aviation industry. The airline had been a trailblazer and a benchmark of success. Its sudden absence left a gap in the market that was difficult to fill and raised questions about the sustainability of India’s aviation sector.

Unpacking the Controversies: The Role of Debt, Expansion, and Adaptation

Jet Airways’ collapse was not without its share of controversies and strategic missteps. Three significant factors stood out:

- High debt levels: By the time it ceased operations, Jet Airways was buried under a mountain of debt exceeding ₹8,000 crore (equivalent to ₹9,900 crore or US$12 billion in 2023). This astronomical debt severely restricted the company’s financial flexibility, making it almost impossible to secure additional capital for investment or debt servicing.

- Unbridled expansion: Jet Airways’ management was often criticized for prioritizing expansion over profitability. The acquisition of Air Sahara in 2007 for a whopping $200 million became an albatross around the company’s neck, failing to deliver the synergies or market advantages anticipated.

- Failure to adapt: The airline was slow to respond to the rise of low-cost carriers. As IndiGo, SpiceJet, and others gained market share, Jet Airways stubbornly stuck to its full-service model. This rigidity cost them dearly as they found themselves outcompeted and losing market share.

Over the past twenty years, quite a few well-known airlines in India have gone under, despite the aviation market growing to become the third largest in the world. When we look into the workings of the aviation industry, we can use a well-known model called Michael Porter’s Five Forces to understand why it’s not making a lot of money.

Firstly, the companies that supply planes have a lot of power. There are only two companies in the world that make airplanes (Airbus and Boeing), and they can charge a lot because of this. On top of that, the fuel that planes use, known as Air Turbine Fuel (ATF), is very expensive because it’s sold by government-owned petroleum companies and has high taxes added to it.

Airlines also have to pay to get good spots at airports. This money goes to the Airport Authority of India and the company that runs the airport. But while all these costs are high, airlines can’t charge much for tickets because there are so many airlines competing with each other. This means the prices have to be low, so the airlines are struggling to make enough money to cover their costs.

Reflections and Lessons: The Legacy of Jet Airways’ Bankruptcy

The fall of Jet Airways serves as a stark reminder to businesses, particularly those in the volatile aviation industry, of the perils of over-leveraging and the importance of adaptability. High debt levels can cripple even the most successful companies, restricting financial flexibility and hamstringing operations.

Meanwhile, the inability to respond swiftly to market shifts – in this case, the rise of low-cost carriers – can leave businesses exposed to competitive threats. It’s a sobering lesson for other airlines and industries alike: adaptability isn’t just a competitive advantage; it’s a matter of survival.

Despite the gloom surrounding its demise, the story of Jet Airways isn’t one of unmitigated failure. It’s a tale of ambition, growth, and missteps, of lessons learned the hard way. It serves as a poignant reminder of the cyclical nature of business and the need for balance between growth and financial stability.