If you did the classic Google search to ask this question, you will probably get something along the lines of cash-flow problems. If you dig deeper, you might find other options like wrong-fit products, getting outcompeted, and having a flawed business model. But really, did you even have to run a web search to figure that out? Call it intuition, but these options appear to be obvious hows packaged on the internet asWhys.

So you might want to ask again, WHY DO MOST START-UPS FAIL?

If the how if a function of a situation, then why is a function of the reason behind getting into the situation. In other words, if the major cause of start-ups failing is a matter of cash flow, then the why has to be connected to poor money management. And you dont have to look very far in start-up culture to understand why this is likely the case. For the purpose of this article, the leading cause which is cash flow problems will be taking a center stage. Others will have their day in the sun anothertime.

Start-up popular culture tells us to spend more to attract the besttalent

Weve seen the offices on Linkedin, and lets not even get into the brag of being a techie and making big bank. Weve also seen the movies like The Social Network and the TV show Silicone Valley. While not every start-up is a tech endeavor, the industry has come to set the standard for start-up growth and culture so much that they have convinced founders everywhere to spend money they cant sustain. You know, to attract the best, you need crazy office spaces with bean bags and ping pong tables. And of lets not forget, a salary that can compete with a bankrobbery.

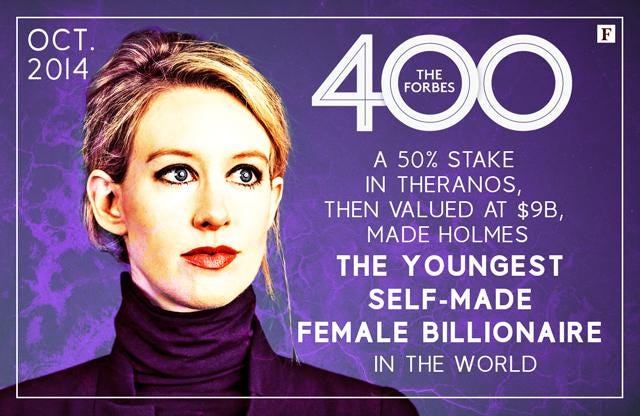

Chasing clout over real economic value to attract investors

When investors have become so prone to image and presentation that Elizabeth Holmes nearly got away as the Start-Up Swindler, then you know there is definitely a wrench in the cogs. As more founders become convinced that hype and noise are actually assets to aid in attracting funding, they will keep investing in bizarre marketing tactics to hit a metric that might actually have no real economic value. A serious reorientation will be needed to rediscover what is actually valuable, and what is fluff to stop start-ups from dying in the chase of clout. Appearing on Forbes for example is NOT a metric??ask Invictus and Kanye West who wrong they canbe.

Following the gut when the data speakslouder

Striking the balance between listening to data analytics and to your gut isnt as easy as it might seem for founders. With strong attachments to ideas and the work and money that has been sunk in to propel them; bitting that bullet and pulling the plug or making a serious pivot isnt always a breeze. When its a SaaS product with branding, marketing, and code infrastructure already down the drain; pumping the brakes can easily feel like businesssuicide.

The trap of early success telling founders more money will alwayscome

Sometimes, a start-up gets to raise ten million dollars in its first six months, and all of a sudden there is pressure to spend to expand on growth. All of a sudden, multiple hires are going on across the globe and office spaces are popping up everywhere (no shade to WeWork). When on a roll like this, it only takes a single trip and everything is in shambles because spending was done under the assumption of exponential growth.

There are probably a hundred and two more reasons behind how cash flow is often depleted due to mismanagement, but these are some to keep at the back of your mind while dreaming of that $1billion valuation. And on that note, perhaps there is something to start-ups and the win big or go home mentality we see in casinos??but that is subject for another post. FollowMe!

Why Most Start-Ups Fail: Investigating the WHYS behind the HOWS was originally published in Startup Stash on Medium, where people are continuing the conversation by highlighting and responding to this story.