Authors, Simon Samuel and Caroline Wee

The Coronavirus (COVID-19) outbreak has a myriad of repercussions on Southeast Asia’s economy especially in the travel and retail industries. This does not bode well for marketers, but we deep-dived into our data to dissect the adverse effects and were surprised by what we found:

- Singapore showed declining traffic for travel and retail outlets across the country

- Malaysia is bouncing back from the initial shock of the outbreak

- Thailand’s travel and retail remains steady, partly due to continued support and traffic from the region, which somewhat compensates for the gap left by Chinese tourists

- Indonesia does not seem to be affected by the COVID-19 outbreak

However, marketers can still create successful marketing strategies whilst facing tough market situations in 2020 with these 4 steps.

The Southeast Asian Decline

Economies in Southeast Asia are now facing the consequences of over-reliance on China. Recently, Singapore, Thailand, Malaysia and Indonesia have downgraded their Gross Domestic Product (GDP) forecasts, some anticipating the slowest growth in over 10 years. This does not bode well for marketers, but here are some marketing strategies on how marketers can still come up on top.

Travel Plans Disrupted

Quarantine measures and travel bans have reportedly caused the tourism market in Southeast Asia to plummet and Bloomberg anticipates that the effects will continue well into 2021.

Meanwhile, national carriers like Singapore Airlines, Thai Airways, AirAsia, and Garuda Airlines are also anticipating a drop in revenue as they continue to reduce flights in response to the outbreak.

Does this mean that everyone in the travel industry should be reducing marketing spend and instead focus on promotional tactics? We looked to our data analytics and XACT, our proprietary Data Management Platform (DMP) of 375 million datasets to shine a light on the nuanced market conditions.

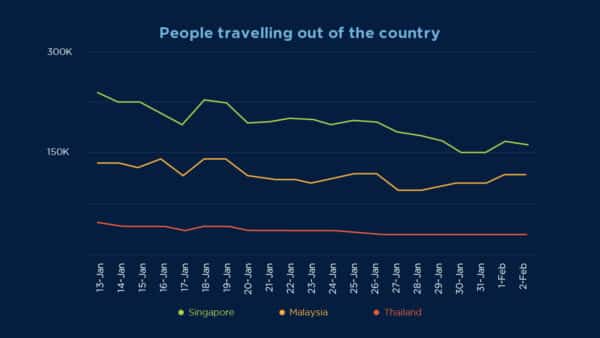

According to insights carved from XACT, travel out of Singapore and Malaysia has been declining steadily, whereas Thailand remains relatively stable despite a few troughs and peaks.

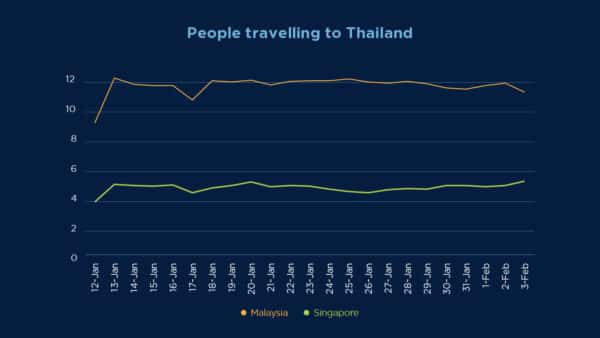

Further analysis demonstrated that people from Singapore and Malaysia continue to travel to Thailand; while cross-referencing with our personas showed that the majority of these individuals are travelling for leisure. This demonstrates that both countries are a viable market to fill the gap left by Chinese tourists.

In true “Malaysia Boleh” spirit, Malaysians braved the outbreak as they continued to travel back from Singapore during Chinese New Year, and they bounced back quickly to business as usual with over 23.67% identified as Malaysians working in Singapore by our data scientists.

Will Retail Hit an All-Time Low?

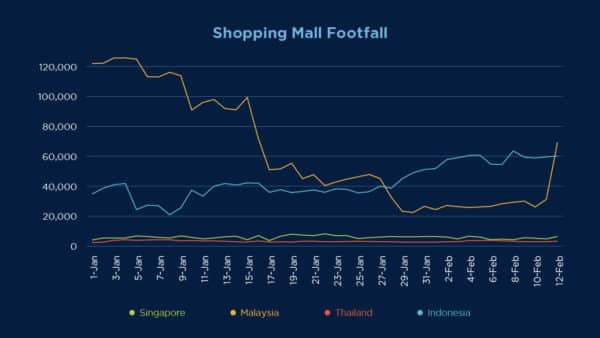

Looking at footfall analytics and consumer traffic to shopping malls has revealed a more nuanced picture of the retail industry in Southeast Asia.

Singapore anticipates that its retail sector will be the worst since 2013, while countries with a heavy reliance on demand and manufacturing from China will also suffer a GDP loss of over 0.3% for Thailand and Malaysia.

Locally, stores have also faced the effect of self-imposed restrictions from the public with over 52% of Malaysians saying their behaviour has changed, according to a poll by BFM.

Overly cautious, people in Singapore have gradually stopped frequenting malls while those in Malaysia bounced back rather quickly, despite a steady increase in the number of COVID-19 cases in the country. Thailand has maintained a steady wave of traffic to their retail outlets while shoppers Indonesia appear to be visiting malls more frequently, possibly bolstered by government statements of the country being “virus-free”.

Southeast Asian Marketers Can Still Come up on Top!

Marketing strategies should vary by country, so marketers in Singapore may want to adopt cost-saving messages whilst prioritising targeted paid digital marketing campaigns, similar to Sainsbury’s ‘Feed your Family for a Fiver’ campaign.

For marketers in Malaysia, they should steal the spotlight as brands dial back their paid advertising in response to pessimistic growth projections in 2020.

Marketers should take advantage of the decline in tourism in Thailand and Indonesia by focusing on brand building to be better positioned in the mind of consumers once the good times pick up again. It certainly worked for Virgin Atlantic during the 2009 economic downturn.

Read our full 4 steps on marketing during a less than ideal year here.

By: Simon Samuel, Head of Data Analytics, ADA & Caroline Wee, Marketing Manager, ADA

The Facebook Pixel In A Nutshell

Do you have an article, infographic, podcast, presentation slides, press release or a key individual from your organisation that you'd like to highlight on Marketing In Asia? Head on over to Upload Your Content for more info.